Flexible by design

OpenWay’s CTO on why Way4 differs from every other payments platform

Dmitry Yatskaer is the Chief Technology Officer at OpenWay, with over 25 years of experience in the payment industry. He oversees the Way4 product development strategy and actively participates in OpenWay’s most sophisticated projects. He advises clients on the optimal payment solution architecture, new business line development, and large-volume card and merchant portfolio migrations. Dmitry has contributed to the successful launch of CMS platforms for ACB, Borgun, Comdata, Equity Bank of Kenya, equensWorldline, Halyk Bank, Network International, Nets, SIX Payment Services, and others.

Which of the following scenarios aligns with your organization's needs?

-

You are currently an issuer of debit or prepaid cards and wish to expand into credit cards. Suddenly, you spot a market opportunity to become an acquirer or explore the digital wallet space.

-

You are a payment processor accustomed to working with well-established banks. Now you are seeking to onboard fintech companies and need to create an enticing offer for them.

-

You are an acquirer in your own country and have set your sights on global e-commerce. Consequently, you require new pricing models, distinct features, and specialized expertise.

-

You are an ambitious fintech that has developed a flexible embedded finance solution. Depending on your customer base's response, you might need to swiftly modify your offering or spin off into a different branch of business altogether.

Do any of these scenarios sound familiar? Perhaps you already have solutions from various vendors, but you are looking to explore other options. However, implementing and integrating new solutions into your existing technological and business landscape can be a time-consuming and resource-intensive process. Additionally, as your business grows, you will likely require new functionalities and features, even if the initial payment solution project appeared straightforward. To stay ahead of your competitors, it is crucial to choose a payment platform from a vendor that can anticipate and support future growth through innovative functionality. You need a partner that maintains expertise and relevance in both local and global markets. So, how can payment software vendors distinguish themselves in terms of flexibility and seamless launches of payment innovations?

Why flexibility is vital

Why do we prioritize flexibility? From our extensive experience, we understand that time to market is crucial for banks, processors, and ambitious fintechs in the payments industry. This sector is rapidly evolving, with the emergence of new and potentially disruptive concepts like the cloud, AI, metaverse, NFT, smart contracts, and central bank digital currency. Moreover, in many regions classical payment methods coexist with new approaches based on open banking and Web 3.0

As a result, there will be intensified competition and heightened customer expectations for rapid adoption of innovative services. Global fintech companies will be expected to deliver solutions tailored to merchants and their customers, considering unique and untapped niches.

Our clients require two essential elements to thrive. Firstly, software that enables them to compete efficiently by rapidly launching new products and services. Secondly, achieving a better return on investment (ROI) for these offerings, which includes swift implementation of innovations and integrations aligned with market demands and trends. For example, a joint survey by OpenWay and Omdia noted the importance of keeping pace with competition and ensuring product flexibility, while in Latin America “the reality for most of the market is that it takes between one and six months to launch new products.” In Europe, however, this time may be much shorter. OpenWay client Enfuce, a Nordic fintech, is noted for its ability to onboard banks in a matter of 4-6 weeks.

Another OpenWay client, Finaro (now part of SHIFT4) at the start of its business used an acquiring-as-a-service model which became costly as the company began to scale up. Finaro selected Way4’s flexible online acquiring back office, which allows payment companies to efficiently implement complicated processing rules, experiment with innovative services, and collect and process a variety of real-time data while providing uninterrupted processing. Platform flexibility was important for Finaro and its business strategy of going quickly into niche markets. On this, CEO Moshe Selfin noted: “We are the smaller guys who look for the crack in the window and we need a partner who will be flexible with us, to work on these niche solutions to get into the market quickly.” Thanks to Way4’s flexibility, the company can continuously refine and re-invent its offerings, and its merchants can pick and choose from the large variety of value-added services and processes that continue to get rolled out in a matter of weeks.

What differentiates vendors and the flexibility they can offer

Many vendors look quite similar on the surface. They tick all the right boxes and provide comparable customer references, but the way functionality is delivered may be vastly different. Much depends on the vendor’s approach to business and how it develops or acquires its technological offerings.

Differentiator 1. How quickly and easily can you launch products on the issuing side or the acquiring side? What about new services?

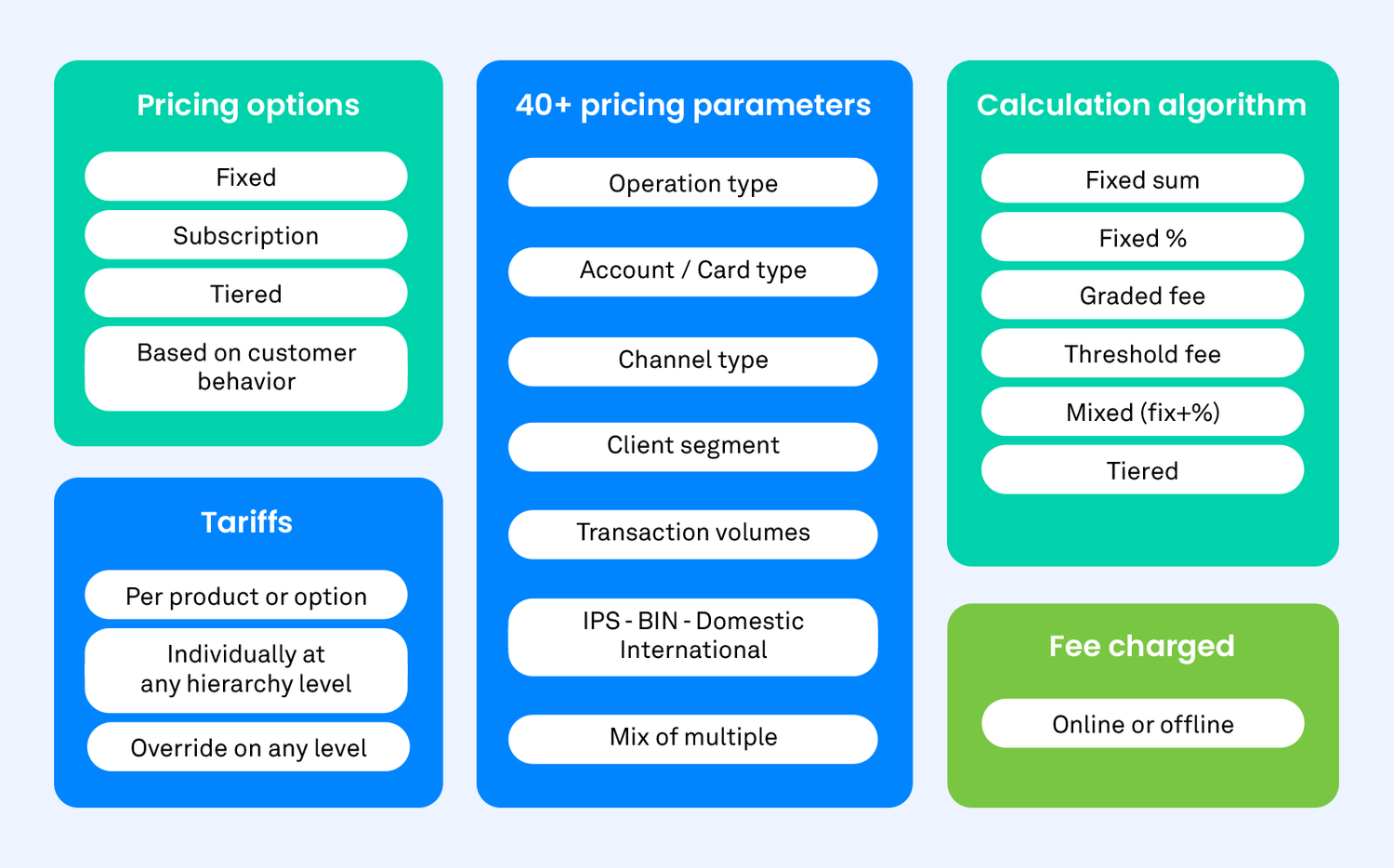

Are you able to release a variety of credit card products and merchant services tailored to your specific needs? What about multi-currency services with an unlimited number of currencies across all your offerings? As an acquirer, can you effortlessly provide dynamic or multi-currency pricing? Can you offer merchants unique payment plans and calculate fees and commissions dynamically online? How many pricing parameters does your vendor's platform support? Will you have the freedom to manage your dynamic pricing rules through a large number of detailed parameters and offer merchants and banks very flexible contract terms? A powerful and innovative platform with enhanced flexibility and end-to-end solutions will yield better returns on investment. It's all about unlocking existing features and maximizing your potential.

Why do some payment platforms fall short of expectations? There are several factors at play. In certain cases, companies boast extensive portfolios that seemingly encompass all bases, but the reality is that they are patched together from various acquired solutions. Let's consider a scenario where a payment software vendor initially offers a basic solution tailored to a specific domain like payment switches. As client demands for different domain-specific software solutions emerge, they acquire solutions from other companies, customize them, and integrate them into their product suite. Over time, these acquired solutions may become outdated without innovation, prompting the development of another product or the acquisition of yet another solution with customizations primarily implemented via code.

This kind of acquisition strategy comes with risks for our industry. The original architects of the acquired solutions may or may not be retained, leading to potential support issues. It introduces numerous obstacles to implementing new services, leading to higher costs and longer timelines. For these reasons, most payment solutions, despite their claims of being omnichannel, do not truly deliver on that promise.

OpenWay takes a different approach to business. We prioritize innovation and develop our solutions in-house through our dedicated development team. We are committed to nurturing an organically growing, single product line. Our solution Way4 is built on a unified architecture and a cohesive set of business rules, most of which can be modified online via screens, API and apps. One of the remarkable strengths of Way4 lies in its parameter-driven approach, which incorporates multiple layers of customizable rules and parameters. This empowers our clients with a wide range of capabilities and enables them to meet the digital needs of cardholders, payment service providers (PSPs), merchants, banks, and processors effortlessly. Not only does Way4 offer powerful functionality, but it also prioritizes user-friendliness, ensuring a seamless experience for end-users.

Differentiator 2. How easy is it to manage your business growth, and how stable is the platform?

Some vendors lack scalability in their products and services, even though they show promise. As organizations grow, these products may undergo extensive customization through scripting and coding to meet specific customer needs. However, over time, the product can stray far from its original form, containing as little as 10% of its initial offering. Supporting and upgrading such customer-specific code can be costly and time-consuming, risking the overall stability of the platform.

It's important to determine if the vendor's offering is a custom implementation separate from their product's main version line. Some vendors create separate versions for each client, which brings challenges like high costs for custom upgrades. Moreover, if the original implementation team is no longer with the vendor, getting support can be challenging. When evaluating vendors and their solutions, it's crucial to carefully consider these factors to ensure long-term stability, cost-effectiveness, and reliable support for your organization.

Vendor principles that give companies flexibility and independence

1. Commitment to a single version line, avoiding custom code

Personalization and customization are vital in business to ensure a product meets the specific needs of clients. However, relying on numerous variations of custom code is not the most effective approach. OpenWay takes a different approach by maintaining a single version line for all customers. This ensures control over quality and security, and enables instant delivery of all available features worldwide. However, imposing the same behaviors and features on all clients wouldn't be ideal. To strike a balance, OpenWay’s highly configurable platform allows each client to create their own unique offerings, including customized payment processors for the banks they serve. This approach enables our clients to swiftly introduce new products and services, save costs, and gain a competitive edge.

2. Flexible architecture where customization is data-driven instead of code-driven

The vendor plays a crucial role in delivering the necessary flexibility for each client to stand out and ensuring manageable and easily updatable customizations. Achieving this requires an architecture that minimizes the need for coding on the client side. Ideally, changes should be driven by business rules and parameters rather than the code itself. Way4, for example, allows approximately 95% of its features to be customized from the start using flexible parameters, surpassing other companies that typically offer customization for only 30 to 40% of their features, often requiring coding or “light scripting”.

In summary, striking the right balance in product development is more of an art than a science. It involves creating products that can continually grow their features while accommodating the organization's expansion in various domains. This includes efficiently managing different types of cards, non-card payment methods, credit schemes, e-commerce, POS acquiring, and switching, ensuring competitiveness in all these areas.

Flexible by design enables as many ideas as possible

We have seen many examples where the kind of flexibility by design that OpenWay offers makes a difference. Particularly for issuers, flexibility is essential, because they deal with credit card product behavior defined by a blend of different inputs. Each card issuer has its own product styles, target markets, and traditions, and they also need to adhere to regulations imposed by the country's central bank. Although credit card products may have common features such as revolving and instalment credit lines, there are many differences to consider. Aging, multi-currency credit lines, minimum number of payments, credit limits, penalty interest calculation…the list goes on. Some vendors give up and add features using custom code, but that is just a slippery slope. We’ve seen many card issuers who migrate from an in-house legacy processor. These issuers already have existing credit card products with established behaviors that they want to retain. However, they also want a faster time-to-market for introducing new and exciting features made possible by the new platform.

Acquirers also need flexibility to release quickly new solutions to support digital payments. They need VAS for commodification of core payment services, and they must comply with changing regulations and standardize their offerings for faster time-to-market. It might be that an authorization scenario is working quite well, but needs to be adapted for a specific segment, such as electric charging stations, or multi-currency payments may need to be enabled for merchants. SME merchants increasingly need online and instantaneous settlement.

Fintechs also benefit from this flexibility, because there is a lot of uncertainty and different variables to how the initial idea and their approach to the business may change in the future. For fintech companies, it's crucial to avoid getting stuck during development due to limitations from the vendor's side. At OpenWay, we believe in providing companies with the freedom to innovate and the flexibility to modify as many parameters as possible on their own. This approach empowers companies to adapt and evolve according to their changing needs and ensures they are not dependent on external factors for essential features. For them, it is a great opportunity to develop in-house expertise. Once you get deeply familiar with the product, you can start innovating and proposing ideas to the vendor partner to bring different services to the market. You have the freedom to focus on selling your ideas and perfecting your own UX with its unique style and your analytics, backed by a platform that that is highly available and able to fully accommodate your ideas.

At OpenWay, we follow a philosophy that focuses on creating a data model capable of accommodating our clients' diverse business ideas. We aim to empower our clients by enabling them to implement as much as possible on their own. Whether you're an ambitious fintech or a bank/processor, we believe you should have the freedom to pursue your growth trajectory based on your unique vision.

For banks and processors, we understand the importance of a smooth migration process while preserving the distinct behaviors and logic of your existing products. If you've encountered limitations with your current payment technology, we have extensive experience in migrating from various platforms and legacy systems. We are excited to hear your ideas and share our technology and best practices with you. Let's discuss how we can collaborate to bring your vision to life!

Get instant access to the Way4 brochure by filling out the form below:

![OW 11 [Flexible by design]](https://openwaygroup.com/hubfs/Partners%20portal/Logos%20and%20icons/OW_Logotype_RGB_99x28_s2.png)

OpenWay is the only best-in-class provider of digital payment software solutions for card issuing, digital wallets, merchant acquiring, BNPL, transaction switching, tokenization, and fleet payments, and the best cloud payment systems provider as rated by Aite, PayTech and Juniper Research. Top-tier banks and processors, as well as ambitious fintech startups, have chosen OpenWay as their strategic partner. With its unique capabilities in rich functionality, fast-to-market, high availability and better ROI, the Way4 software platform guarantees an unparalleled customer payment experience.