BNPL, cards and wallets: the technology that connects the dots

.png)

Rudy Gunawan is the Managing Director of OpenWay Asia, the top-rated vendor of the Way4 digital payment software platform. He has been active in the payment industry for 20 years, serving as a consultant to businesses in the Middle East and Asia Pacific. In his current leadership role at OpenWay, he oversees the company's operations in Asia while promoting the board's strategic initiatives.

Table of contents

The convergence of wallet-based and card-based BNPL offerings

Just two years ago, BNPL (Buy Now, Pay Later) wallets were positioned as an invincible challenge to international card schemes and called “a billion-dollar plan to destroy credit cards”. But the competitive rhetoric soon gave way to cooperation. Even the most successful BNPL app providers have opted to collaborate with supposed rivals: Afterpay introduced the Afterpay Plus card, a contactless Mastercard product, and Klarna began offering its Pay in 4 service as a physical Visa card.

This emerging reliance on card rails for BNPL products is driven by several factors. The most obvious is the ability to avoid heavy investment in onboarding retail partners. Visa and Mastercard have already enabled all their merchants worldwide to accept BNPL cards. Card network payments also offer the big advantage of eliminating compliance issues.

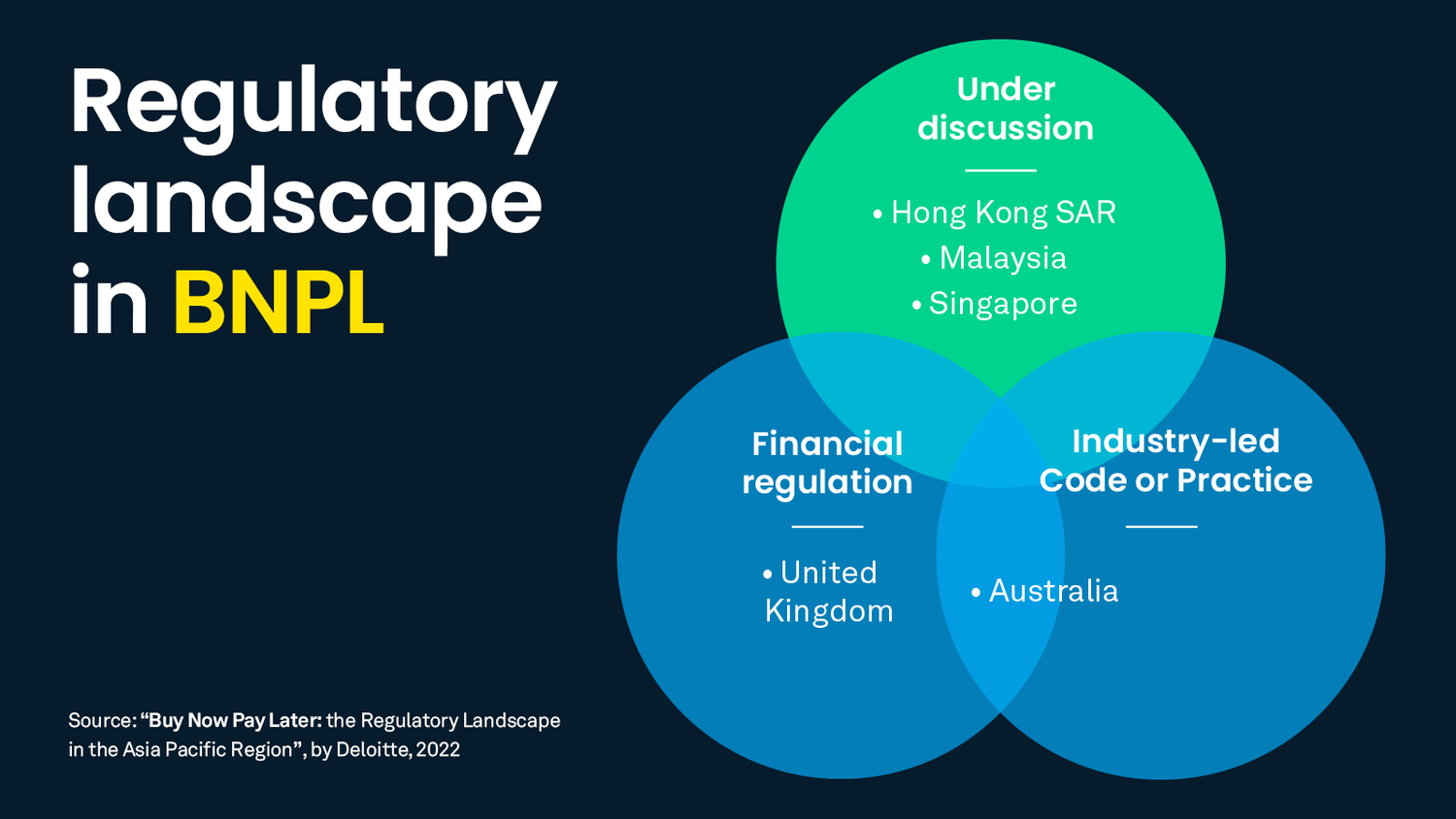

On the other hand, non-card BNPL plans, typically based only on "soft" credit checks, have remained a grey area raising concerns among payment regulators and consumer advocacy groups. According to Deloitte, legislators in Singapore, Malaysia, Hong Kong, and Australia are taking actions to impose stricter regulations on BNPL providers, with similar developments expected in the US and UK. The new regulations are likely to be similar to those for traditional credit products. For example, Afterpay prevents merchants from adding a surcharge to the purchase price, but the Reserve Bank of Australia is promoting regulation to eliminate no-surcharge rules for BNPL companies, so its merchants can add surcharge in the same way as Mastercard’s merchant network.

To leverage established card industry standards and embedded lending innovations, several major issuers and consumer finance companies have implemented their BNPL offerings on OpenWay's top-rated Way4 software platform. Due to its adaptable product setup, Way4 has accommodated a broad range of BNPL business models:

-

In 2023, Japanese brand JACCS migrated to Way4 to ensure better digital-first customer experiences in consumer finance in Vietnam by launching BNPL services and a digital wallet.

-

In 2021, South Korean brand LOTTE introduced PayLater – one of the first e-commerce BNPL solutions in the Vietnamese market. Participating retailers include flight and hotel booking provider Vntrip.vn and an e-commerce marketplace, Tiki.

-

In 2020, OpenWay and Nets, a European processor within Nexi Group, jointly won a PayTech award as the Best Consumer Payments Initiative for Nets’ Universal Digital Lending Platform. Nets enables banks, retailers and EMIs to launch BNPL products within 2-3 months.

-

In 2006, Procco Financial Services in Bahrain launched open- and closed-loop BNPL products, including Islamic Sharia-compliant instalment cards with multiple tenure options on POS.

OpenWay’s recent case study summarizes the best practices followed by these and other payment industry players, while highlighting key technology that helps companies avoid the pitfalls encountered in implementing BNPL solutions.

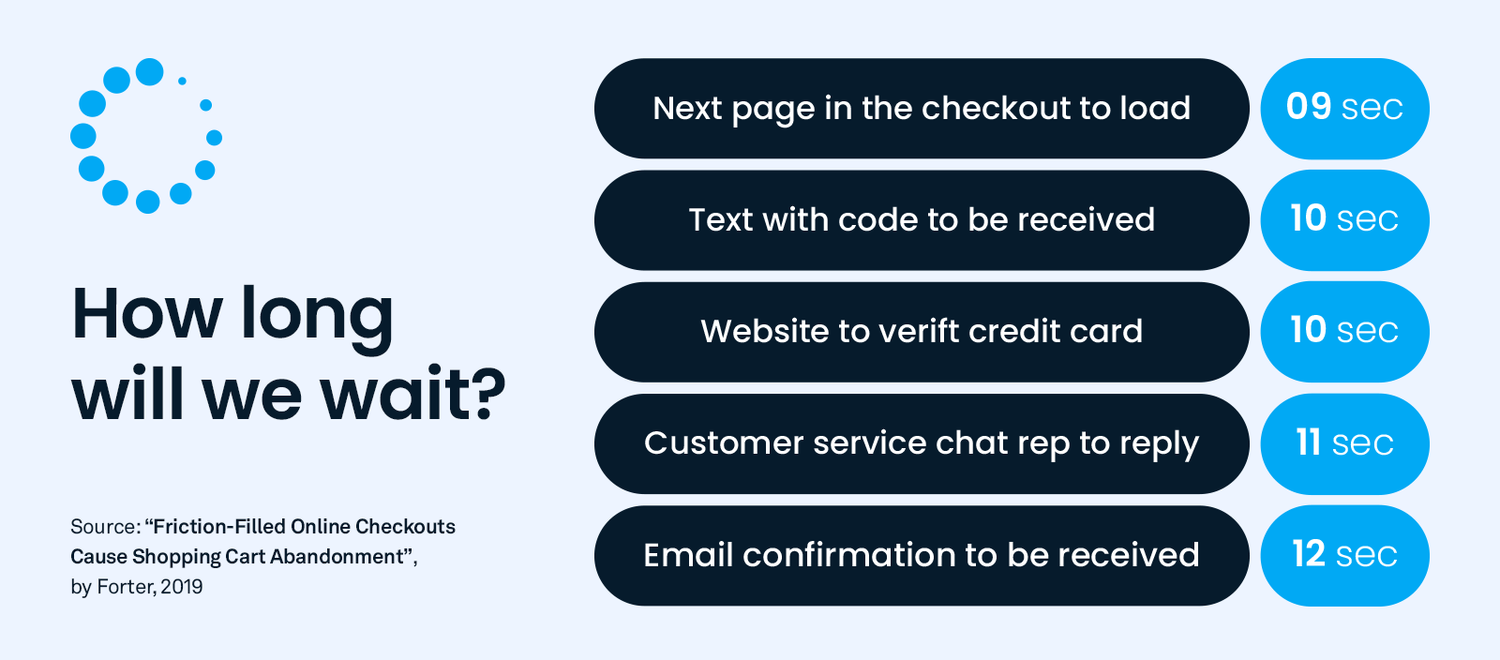

Improved BNPL customer conversion via real-time front-to-back processing

E-commerce studies show that a checkout page that takes more than 9 seconds to load will result in an abandoned cart. A quick payment experience is also vital for in-store POS transactions. As an additional checkout step, selecting and approving an instalment plan should take seconds, not minutes. Speed is essential to an excellent customer experience and a successful BNPL payment.

Way4 is the only card issuing and loan management platform in the market that features a 24/7 online back and front office, real-time front-to-back reconciliation, and online accounting. Thanks to this, both customer onboarding and activation of pre-approved instalment plans take place in a matter of seconds.

“It was important for us to find a technological solution that would allow us to take into account the requirements of large online retailers in Vietnam for a seamless checkout experience.”

Complicated refunds deter BNPL customers from using the BNPL option again. According to PYMNTS, merchants reported that “BNPL had complicated their return policies and disincentivized customers from leveraging the platform due to this added effort. Most cases involved the consumer contacting the merchant as well as the loan provider and continuing to make payments on the item until the return is fully processed. This, in turn, makes customers less likely to purchase items such as clothing that have a high probability of needing to be returned.”

Way4 simplifies refunds by processing chargeback in real-time, whether the request comes from a POS terminal, e-commerce store, call center, BNPL customer’s mobile app, or any integrated third-party system. The platform promptly cancels loans, deducts any applicable interest and fees, and refunds the remaining amount, or puts repayments on hold until the order return is confirmed. The customer and the merchant get notifications on the fly. BNPL providers can configure multiple chargeback scenarios according to their internal policies.

How to expand your BNPL acceptance network: virtual instalment cards on a mobile wallet

Offering BNPL products as Mastercard and Visa cards may expand acceptance networks, but it is hardly cost-efficient to issue a new plastic card for each instalment plan. Moreover, a digital-first experience is preferred by customers.

OpenWay offers the best of both worlds, since its Way4 platform enables BNPL providers to issue virtual instalment cards and make them instantly available via mobile wallet. Customers use these cards to complete their on-POS, e-commerce or in-app BNPL transactions.

There are markets where the mobile component may be a deal breaker. In Vietnam, for example, a largely unbanked population is unused to cards, and many SME merchants only accept alternative payment methods. In this market, Way4 enables Mirae Asset Finance Company to activate loans via mobile QR code payments.

Mirae Asset’s customers scan the code in store using the MAFC My Finance app, enter the transaction amount, and confirm the payment. Way4 manages customer and merchant information, creates instalment plans, and processes accounting and merchant settlement accordingly.

A closed-loop BNPL payment network can rely on a wallet-only solution without the card issuing component.

Online customer data analysis for compliance and minimized delinquency

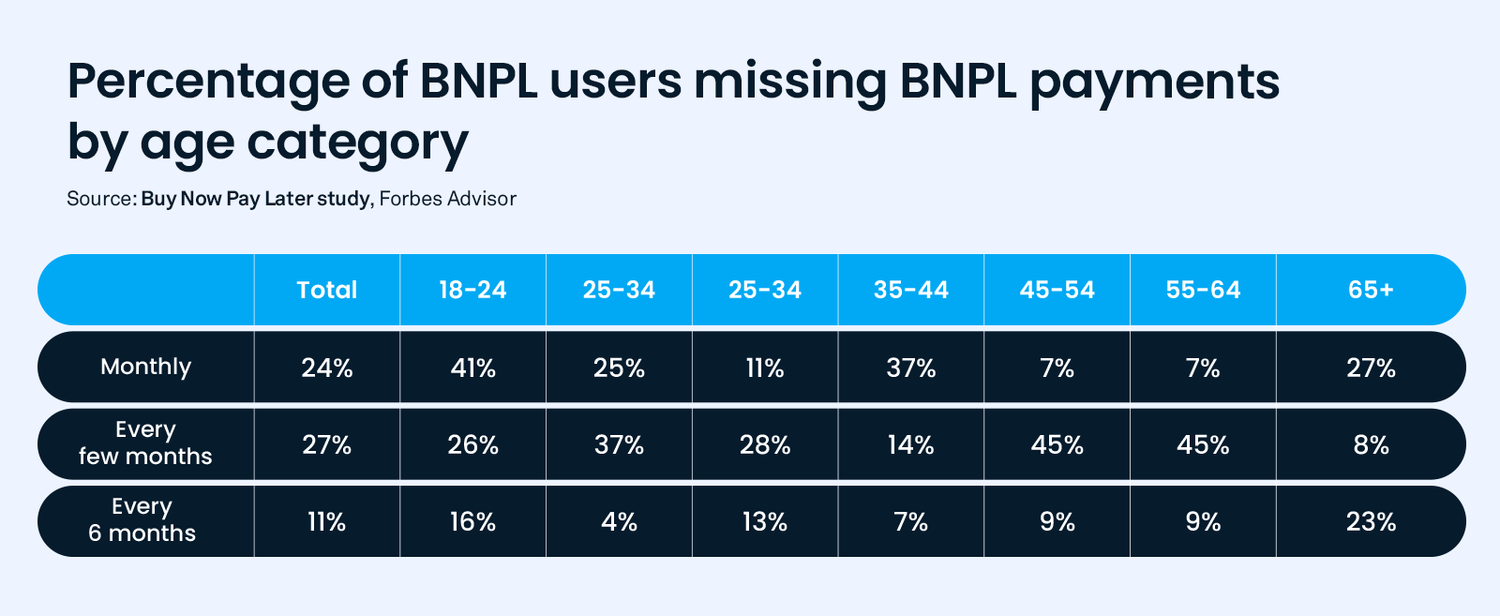

According to Harvard researchers, the BNPL delinquency rates are outpacing those of credit cards. In the US alone, “BNPL use causes a permanent increase in total spending, stretching the average household retail budget 30%.”

The risky practice of issuing BNPL loans after only "soft" credit checks has raised concerns among regulators in many countries. The payment industry may soon see much stricter scoring standards. Organizations such as Equifax, Experian, and TransUnion are already expanding their existing products to include BNPL financing or working with BNPL providers to create new credit-reporting products geared to BNPL transactions.

Way4 not only integrates with major credit bureaus, but also allows BNPL providers to configure their own comprehensive scoring and onboarding scenarios, also transaction limits. The platform conducts real-time analysis of customer accounts, cards and repayment plans. It also checks the credit balance of third-party cards linked to the customer’s mobile wallet, and can stream various types of customer data from external systems.

Way4’s online data analysis provides a more complete picture of the customer’s financial situation and further improves the accuracy of scoring decisions. If the total existing debt exceeds the provider’s threshold or some other requirement is not met, the new loan origination is declined in real time, or the customer is offered a longer repayment period.

Personalized BNPL options to satisfy each customer segment

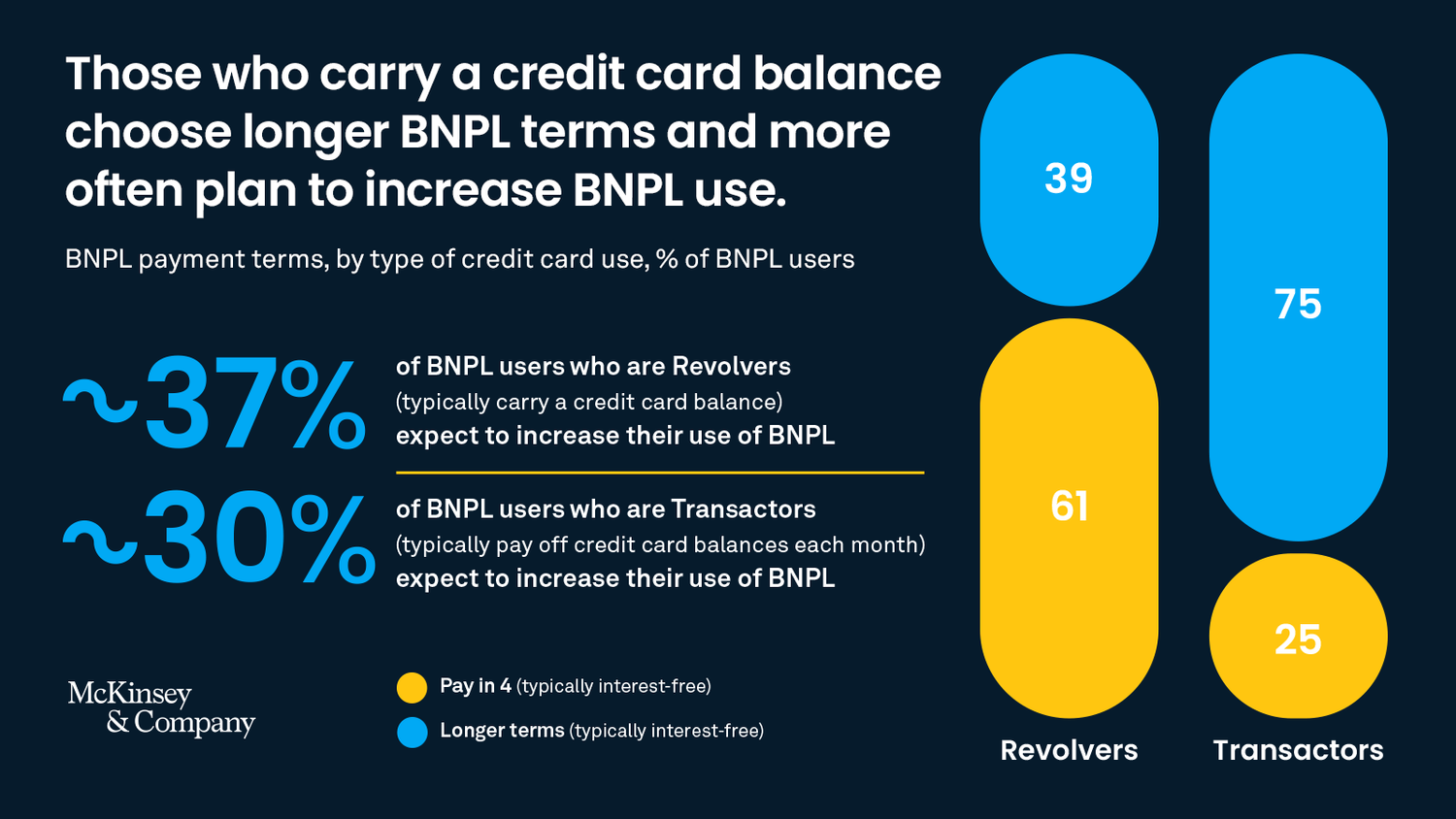

According to McKinsey, credit card users demonstrate two distinguished behaviors. There are “Revolvers” who keep credit balance and drag it into new month, and “Transactors” who pay their card balance entirely every month. The same is observed in the BNPL niche. Some customers don’t mind a longer instalment plan with interest, while others only agree to “pay in 4”. Way4 product configuration has the flexibility to satisfy both segments.

For even greater flexibility, Way4 can let customers restructure instalment plans for longer terms with lesser repayments, choose a currency for each BNPL card, and get pre-approved loans for non-spontaneous shopping. The platform can analyze in real time over 40 parameters of the ongoing transaction and historic data like the customer’s credit history and repayment patterns. This helps the BNPL provider make an offer that is more likely to be accepted by a particular customer.

Sebastian Elbel, Head of Lending Products at Nets, participating in a webinar about Buy-Now-Pay-Later services for banks, has highlighted another advantage of Way4 that helps personalize the customer experience.

“One of our core services is to convert a card transaction into an instalment. It might also be also interesting to combine multiple transactions into one instalment plan.”

This works well for a variety of purchases related to a single event, like a wedding or a vacation.

81% of Gen Z’ers surveyed by EY demonstrated that personalization affects the depth of their relationship with a financial institution. If you are looking for technology that can inspire customers to embrace your BNPL offering and integrate it into their lifestyle, our team is eager to hear your ideas and offer additional insights!

“We believe that to become a leader in a new market and keep your leadership, we need to work with trusted leaders. It was critical for us – the high quality of the Way4 platform, fast time to market, successful experience of OpenWay globally and locally, excellent client service, and high operational efficiency.”

OpenWay is the developer and provider of the Way4 digital payments software platform for tier-1, mid-size and startup players – including card issuers, acquirers, processors, telcos, payment switches, fleet companies, and digital wallet providers. Gartner, Omdia, and Aite have ranked OpenWay as the best digital payments software provider and the best payment solution in the cloud.

Learn more: analytic reports, news and case studies

-

Deloitte: Buy Now Pay Later: the Regulatory Landscape in the Asia Pacific Region

-

Forter: Friction-Filled Online Checkouts Cause Shopping Cart Abandonment

-

McKinsey: Reinventing credit cards: Responses to new lending models in the US

-

Forbes: Buy Now Pay Later Usage Soars As Cost-Of-Living Crisis Bites

-

Juniper Research: Payment Declined: How Virtual Cards Could Drive BNPL Acceptance

-

Forbes: Buy Now, Pay Later: The New Credit Card Acquisition Channel

-

Reserve Bank of Australia: Developments in the Buy Now, Pay Later Market

-

Norton Rose Fulbright: Buy now pay later: Regulation Around the World

-

PYMNTS Intelligence: The Advantages and Challenges of BNPL for Merchants

-

EY: How can banks transform for a new generation of customers?

-

Nets: Why banks can benefit by adding Buy-Now-Pay-Later services

-

OpenWay: JIVF Selects OpenWay to Become a Consumer Finance Leader in Vietnam

-

OpenWay: Mirae Asset Finance Launches Miraeasset Credit in Vietnam

-

OpenWay: Procco in Bahrain Selects WAY4 to Implement its Sharia Compliant Retail Financing Programm

-

OpenWay: Nets and OpenWay Awarded for Their Universal Digital Lending Platform

-

OpenWay: LOTTE Finance and OpenWay Introduce New BNPL Service to Vietnam