Way4 Digital Wallet

A complete payment ecosystem built on Way4

What does a Way4-based payment ecosystem look like? It is a fully integrated, end-to-end payment processing environment that includes card issuing, e-commerce acquiring, POS terminal and ATM management, Mastercard and Visa connectivity, BNPL services, credit management, and support for national and regional payment switches and hubs.

Way4 is consistently rated as the industry’s top digital payment software for digital wallets, card issuing, and merchant acquiring.

Accelerate time to market

Speed matters. Every month you save in project implementation translates to millions in savings and added revenue, not to mention a stronger competitive edge. According to BSG, fast innovations are 18x more disruptive.

Our agile implementation methodology focuses on iterative cycles, maintaining close collaboration with clients, and continuously adapting to feedback.

The result? Faster launch of high-impact innovations and lower costs.

Fast client and merchant onboarding

Way4 enables new users and merchants to start making payments in just minutes, thanks to flexible, regulatory-compliant onboarding workflows tailored for your target market. A few examples:

Timo, a digital bank in Vietnam, offers a quick and fully digital customer onboarding process on Way4 in minutes.

Enfuce, a global provider of cloud-based payment services, empowers banks to deliver 3-minute digital onboarding on Way4.

Rapid launch of new payment products

With 95% of features configurable via parameters (compared to 30–40% in competing systems), Way4 empowers rapid innovation without coding delays.

Example: launching a multi-currency wallet is simple—Way4 lets you configure per-currency card usage, fees, limits, and real-time external exchange rates with personalization for each customer segment, whether individual or corporate.

“The new JIVF payment system, built on the highly configurable Way4 platform with its integrated online back- and front-office operations, ensures a digital-first customer experience.”

First-to-market innovations

OpenWay pioneered the wallet-as-a-software-platform concept and introduced the first white-label digital wallet solution in 2011. Today, our clients continue to drive payment innovation, launching cutting-edge services ahead of the curve:

Designed for high-growth businesses

Way4 is designed for scale—whether you are starting locally from scratch or expanding globally. Its robust technical architecture delivers high availability and seamless performance:

-

3,400+ Transactions Per Second (TPS)

-

100+ million active customers

-

99,99% high availability

-

Omnichannel: mobile, web, POS, API

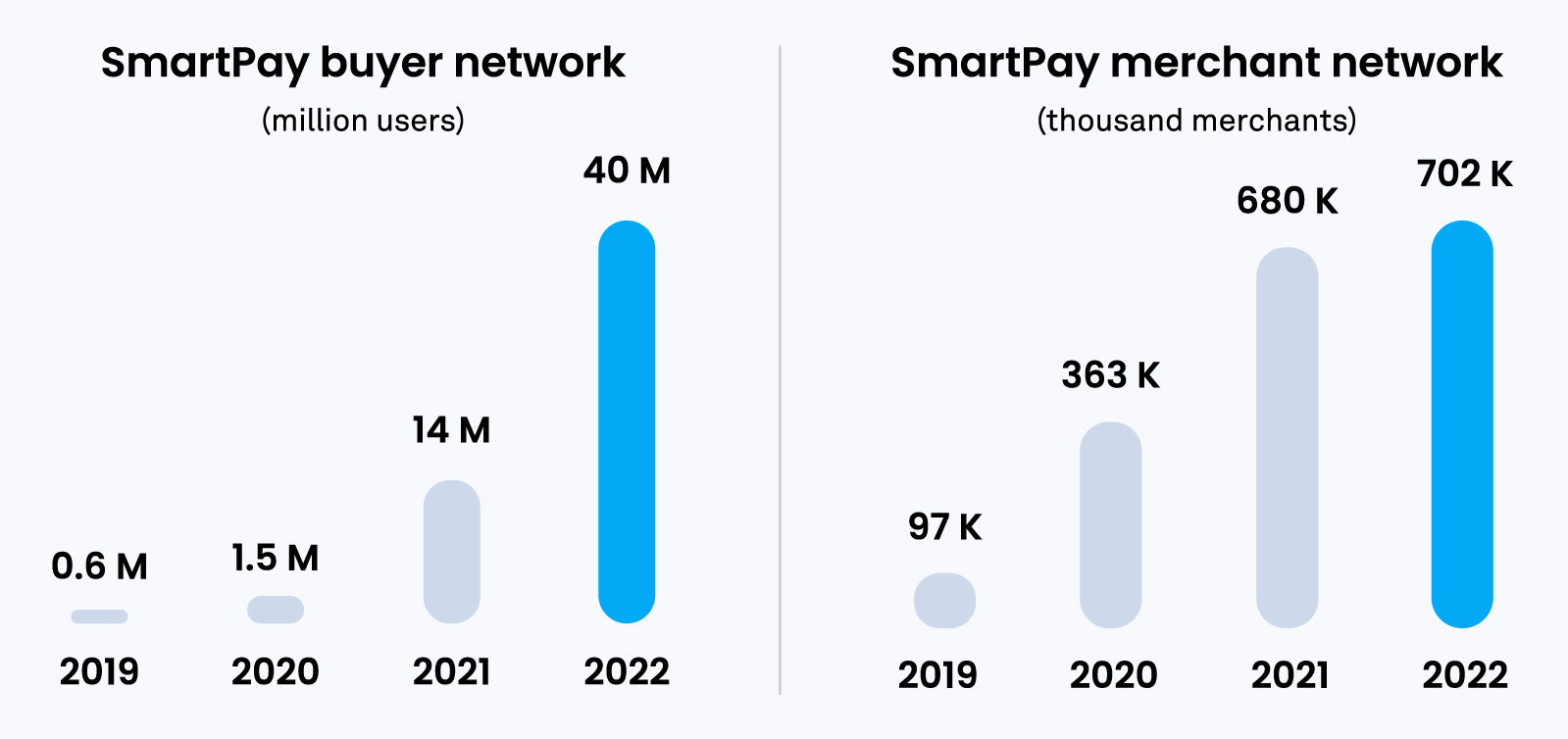

Case in point: SmartPay scaled from 0 to 40 million customers and 700,000 merchants in just 3 years on Way4.

From wallet to full-scale financial ecosystem

Way4 is more than just a wallet—it’s a modular financial ecosystem that grows with your business.

Seamless integration of card rails for issuing and acquiring

Start with a wallet and expand seamlessly. With Way4’s modular architecture, you can integrate card rails and payment functionalities without disruptive migrations or costly system overhauls. To unlock new revenue streams, add:

Integrated customizable credit schemes

Diversify your digital wallet with configurable credit products: BNPL (Buy Now, Pay Later), SNBL (Save Now, Buy Later), installments.

Open banking

Seamlessly integrate with global and local payment networks, core banking systems, and external partners.

Cross-border payments

Reach a global market with instant payments, multi-currency wallets and transactions, and real-time FX rate conversion.

Flexible deployments

Way4 allows you to choose the implementation type that suits your business: in-house, cloud, Dedicated SaaS, or Shared SaaS installations.

Customizable. No limits

In digital payments, flexibility is your strategic edge. With no re-coding or delays, Way4’s rule-driven architecture enables:

-

Custom pricing and installment plans

-

Multi-currency accounting with dynamic exchange rates

-

Tailored credit rules and fee settings

-

Customized authentication, risk management, and transaction approval

-

KYC, and compliance workflows by geography or customer type

Smart automation for maximum efficiency

Automate core operations with Way4 to boost ROI:

-

Instant KYC and AML compliance

-

Real-time fraud alerts and risk management

-

Automated chargeback workflows

-

Real-time multi-party, multi-currency reconciliation

Enterprise-grade security standards

Security is at the core of Way4’s design. With robust security protocols, Way4 ensures compliance with global standards and supports multiple KYC and risk management levels.

-

PCI DSS compliance

-

Tokenization and 3-D Secure

-

Multi-Factor/Strong Customer Authentication (SCA)

-

Real-Time Risk Management

Partner with a proven leader in digital payments

In today’s fast-moving financial landscape, success requires more than technology. It takes a strategic partner committed to helping you lead. Way4 empowers you to accelerate time-to-market, scale seamlessly without limits, drive innovation, and capture new revenue streams in digital payments.

Lead the transformation. Capture the opportunity!

Request a demo or download a brochure today!