Webinar on Digital Wallets

From Financial Inclusion to Multi-Functional Ecosystems

With the current pandemic situation, wallets have become of greater interest to an increasing number of companies around the world. Several experienced payment specialists were invited to comment on how digital wallets are developing today, and what factors lead to their success.

Here is the full webinar recording. Additionally, for your convenience, we have split the webinar on separate videos. Each video devoted to a speaker’s presentation is available below acсompanied by the story with the main facts and insights. Enjoy watching!

Full webinar recording

Quick access:

00:37-11:52 Kieran Hines, Senior Analyst at Celent

13:28-27:16 Marek Forysiak, CEO at SmartPay

29:46-49:45 Papa Mbaye Dièye, CEO at Emeraudia

51:15-01:04:00 Maria Vinogradova, Director of Strategy and Market Intelligence at OpenWay

1:04:46-1:25:00 Q&A session

The digital wallet landscape: what is a digital wallet today, and what does the future hold? - Kieran Hines, Senior Banking Analyst at Celent

Kieran Hines is a Senior Analyst at Celent with almost 20 years of experience in the banking consultancy industry. Prior to joining Celent, Kieran was Research Director for the Financial Services Technology and Industries teams at Ovum (now Omdia).

What are digital wallets? The term is used to describe a growing array of different products and services. As defined by Celent, a digital wallet is a service designed to remove friction from digital payments or digital commerce. Common functions can be grouped into three areas:

Payment services – usually front and center, security plays an important role

Context-relevant form factor – dependent on channels and different approaches to wallet use

Non-financial services – merchant-dependent, ticketing, advance ordering, loyalty, and more

Digital wallets have evolved in line with changing customer needs, merchant needs and technological advantages, but the emphasis on removing friction remains unchanged. Wallets have become increasingly feature-rich, alongside addressing ever more complex areas of customer friction. The rise of high-feature smartphones has provided the technological means to deliver multi-functional wallets. These act as financial inclusion tools to various untapped markets, both individual customers and micro-enterprises. Digital payments, although they are often the starting point for new wallets, are now overlapping with these and non-financial goals to create complex products and services. They are often multi-currency and cross-border, offered by an increasingly competitive range of players, including not only banks, payment providers, and merchants, but also big tech, telecoms, transportation and health organizations. Often, they have very different business goals for enhancing value propositions through wallets, which explains the diversity of digital wallets in today’s market.

In the future, new wallet offerings will emerge, and existing offerings will become more feature-rich. The same forces that drive wallet development today, such as the growth of online commerce and demand for contactless payments, will continue to drive development in the years to come.

Three factors will accelerate the pace of change:

Greater emphasis on and innovation around financial inclusion. Success of current initiatives and reduction of costs through wallets will continue to grow.

New real-time payment infrastructures. Particularly, services overlaid over real-time infrastructure will become more crucial in advanced markets. Examples in Europe include Swish in Sweden and MobilePay in Denmark. Real-time infrastructure can also potentially reduce costs while delivering more value to merchants.

Open banking and partnerships. There is a shift in attitudes, favoring partnering with other organizations to gain access to particular customer segments and groups that cannot be accessed by financial institutions on their own.

Smart Pay: creating real value, where and when it matters - Marek E. Forsyiak, Executive Chairman and Founder, SmartNet

Marek E. Forysiak is the Chairman of the Board at SmartPay, one of the leading eWallet companies in Vietnam. The SmartPay wallet connects 1,700,000 consumers and 300,000 merchants, and has been using Way4 for core payments and its wallet platform from the beginning. In his presentation, he describes what factors contributed into the success of SmartPay, and how the wallet impacts the dynamic environment of payments by creating a capitalized network of buyers and sellers with a focus on the “higher value of money”.

Transformation of money movement has been going on for a number of years. When we think about where that has been most successfully demonstrated, Asia comes to mind. Of late, Alipay has reached impressive results in a very short period of time in market capitalization, now almost equal to JP Morgan Chase’s. It is a testimony to how digital technology is really changing everything. With over 70% of consumers in Vietnam using and accessing internet services, there are over 125 million mobile subscriptions in the country, more than the total population. The government has taken significant steps recently to digitize financial services. Over 39 wallets have been licensed to promote the digital economy. Due to all these factors, there is fierce competition in the digital payments market in Vietnam.

SmartPay at a glance

SmartNet started out as a traditional intermediary service that sold loans, insurance, and other financial products through physical agents. However, their story began when they started digitizing that intermediation, based on their observation of how buyers and sellers interact and what they experience on a day-to-day basis. This led them to apply for an e-wallet license and to launch their smart app, SmartPay, in Q1 2019.

SmartPay leverages its payment capabilities primarily to enhance the customer experience instead of becoming the main source of revenue generation. It does this by providing payment services at cost in order to maximize the velocity of transactions, then monetizes the rich consumer data collected. The wallet has been purpose-built from the ground up by a local team of experts with accessibility and ease of use remaining our guiding principles. Other principles are:

Single-app approach with separate, unique user journeys for merchants or private consumers

Full online enrolment to include identity verification and KYC. No paper involved at all!

Digitized real-time engagement accessible 24/7. Data subjected to AI and machine learning

No set-up fees or transactional charges

Putting the needs of the merchant first

SmartPay succeeded by focusing on the needs of the growing segment of micromerchants in Vietnam. 60% of retail GDP is generated by micromerchants (5,2 million enterprises), who are usually ignored by classic banks. The benefits to merchants who are in the SmartPay network are numerous: street vendors with few resources are able to not only offer products online and accept payments, but to generate additional income in a number of ways. They can sell insurance products, with the potential of netting the merchant a commission of 50%, sell scratch cards, travel tickets, and hotel bookings in addition to core service and product offerings, earn bonuses by referring users, and act as a POS for loan repayment and bill payments. As their monthly turnover grows, they can obtain a working capital loan.

SmartPay is used by about 300,000 merchants and 1,7 million individual users in Vietnam

The Way4 platform allows SmartPay to democratize payments and develop an ecosystem that brings real value to the micromerchant segment. The ecosystem means that it has to be more than just a transaction or just enabling one person to send money to another person. Real value of the ecosystem comes from understanding a real-time seller-buyers dynamic and from adding capital flow to this exchange. For example, as a member of the VP Bank group, SmartPay can provide buyers with working capital or loans. The company continues to focus on developing beyond basic offerings to more specific ones, many of them unique for the region. SmartPay features that specifically target micro-merchants in Vietnam are:

Payment requests. Merchants can send payment requests using only the customer’s phone number or email address. They can pay with their preferred credit card, or if they hold a SmartPay account, via SmartPay.

Invoices. Merchants can create professional-looking invoices complete with their logo, send them and track payments from a single platform, tokenize customer information, and set up custom recurring billing. This is a perfect option for service businesses. Bills can be sent and payments tracked.

Subscriptions and recurring payments. Whether it’s monthly subscriptions, recurring bills or instalment plans, it’s a lot easier to keep track and manage your recurring payments with Smart Automatic Payments.

Loyalty management. Merchants can create and manage a loyalty program to engage with their customers.

After 18 months, results with the SmartPay app are more than 1,4 million downloads, with more than 300,000 merchants enrolled and over 2 million transactions per month.

Implication of COVID-19

In Vietnam, due to COVID-19 and city lockdowns, large portions of previously acquired micromerchants have gone out of business – according to estimates, as many as 25% to 30%. In general, economic growth and consumer spending have been negatively impacted due to job loss and salary cuts. Tourism limitations also contribute to lost revenue. Small business and street merchants are actively seeking to replace lost revenue and survive in these times. Financial inclusion wallets can play a big role in these goals.

States Marek Forsyiak, Chairman of SmartNet: “We are committed to help the Vietnamese people achieve financial stability. In every interaction on a daily basis, our users get higher values of profitability, convenience, and connection. We firmly believe that everyone deserves access to diverse financial resources to make the most of their money.”

Illimit Pay: mobile financial services for African users - Papa Mbaye Dièye, CEO at Emeraudia

Papa Mbaye Dieye is a founding member of AFRICAN FINTECH NETWORK (AFN), also an economist and financier with more than 20 years of experience in payment systems and digital transformation. In his presentation, he shared his vision on how easier access to e-money and microcredit can help develop a harmonized African digital economy.

Opportunities in the African market

Africa’s mobile money market is developing as entrepreneurs, fintechs and telcos bolster the number of solutions available. Since traditional banking is underdeveloped in many remote areas in Africa, digital money gives people the opportunity to access financial services such as payments and money transfers from their mobile phones. Interestingly, 54% of the worldwide growth of mobile money is in Africa. In Central Africa, mobile money transactions jumped by almost 50% in volume and 33% in value in 2019, reaching 30,5 billion dollars across 17 mobile money services.

ECOWAS (Economic Community of West African States) is the leading sub-region in Africa in mobile internet development. Since 2018, 10 new 4G networks have opened. 3G now represents 49% of mobile connections. In this region, more than 80 million new mobile internet users will emerge in the next 5 years. However, constraints on progress remain: lack of accessibility, cost of infrastructure, lack of interoperability, cost of mobile device, battery autonomy, and social acceptance of mobile usage for women.

Factors that create opportunities in this market are:

Untapped customer niches – gaps left by the traditional banking market constitutes a virgin territory for the emergence of digital payment solutions.

Access to financial services – mobile phones are an easy channel to deliver access to payments, credits and savings products.

Acceptance of mobile money – as acceptance grows, mobile currency can be used to improve individual income.

Growing of mobile usage – all figures point to mobile phones gaining a larger role in the everyday life of Africans.

Diversification – recognition and acceptance of users and the increase in the number of service points to graduation expansion of the African digital economy.

The potential of e-wallets:

Money transfer – people can send, receive and store money safely and securely via smartphone, reducing risks associated with handling cash.

Commerce – businesses can collect payments from customers, purchase stocks, and pay salaries to employees anywhere in the country, providing SMS notifications of every transaction for accounting purposes.

Administration – government can collect taxes and disburse social security payments while enabling charities and non-government organizations to send money to thousands of beneficiaries at once.

Banking – traditional banking networks can rely on digital wallets for a more efficient, cost-effective and less cumbersome interface, attractive to a wide range of customers.

While cash-in and cash-out transactions still represented the majority of mobile money flows in 2018, digital transactions grew at twice the rate, driven largely by bill payments and bulk disbursements. Successful providers are now looking to strengthen their value proposition with a full suite of use cases that serve diverse customer needs.

Major telcos run the show

Mobile money has become big business for telecommunication providers in Africa. Approximately 144 mobile money providers operate in sub-Saharan Africa, with three main companies – M-PESA, MoMo and Orange Money – accounting for a significant share of the market.

M-PESA is a branchless banking service launched in Kenya and the most successful financial service based on mobile phones in the developing world. Customers can deposit and withdraw money from a network of agents that includes airtime resellers and retail outlets acting as banking agents. The service attracted an additional 12 million users from 2017 to 2020 reaching 41,5 million users by 2020. M-PESA users made 12,2 billion transactions in 2020, generating 784,36 million US dollars in revenue for parent company Safaricom.

The second major mobile money service provider, MoMo, is a service created as a partnership between MTN and UBank, available to all South African citizens, regardless of the network they are using. The platform enables customers to use their mobile phones and other devices, to send and receive money, purchase airtime and prepaid electricity, and pay for their municipal bills and DSTV subscriptions. MoMo is available to customers who use both smartphones and basic feature phones. Like M-PESA, MoMo MTN Group’s mobile money offering has enjoyed similar growth reaching 35,1 million active customers in March 2020 using MoMo to make and receive mobile money payments. MoMo added 12,4 million active customers from March 2018 to March 2020.

Launched in 2008, the Orange Money mobile money solution allows millions of people excluded from the banking system to be able to deposit, withdraw, transfer and make payments easily and simply from their mobile phone with complete security. 12 years on since its launch, Orange Money continues to record exponential growth. The service is now available in 18 countries, servicing 45 million customers. The amount of transactions carried out through Orange Money reached 2,6 billion euros in 2019

Easy access to e-money and microcredit develop the African digital economy: case studies

Here are some use cases which clearly show how credit products can improve everyday life of Africans.

Daily credit for a fish seller

A woman living in total poverty with no education and no resources can make steps to be financially autonomous in three weeks with micro credit and digital money. She can borrow $14 from a borrower at a fish market, buys fish with the loan and sells the fish in three hours. She pays back the borrower with an interest rate of 25% for three hours and still makes a profit of $18,75. After 3 weeks, she no longer needs to borrow from the borrower and is self-sufficient.

Fatou is a fish seller relying on a daily credit to keep the business running and growing. The picture shows how she benefits from the financial product

Microcredit for a fisherman

A man with no cash to build a basic fishing canoe borrows $27 to buy an engine and buy some basic equipment. He builds a canoe with a tree from the adjoining forest. All profits from successive fishing expeditions are systematically reinvested in the business. After a while, he has paid back his investors and is now running and financing a fleet of fishing canoes. With a digital solution for money circulation and the concept of mutualized financing, many Africans can improve their financial station.

Assane lives in Africa and starts a fishermen business with the help of microcredit. The picture shows how this kind of financial product works for him

Uberization of distribution

In money transfer, the distance to travel and the absence of a developed traditional banking network are key issues in Africa. When two parties need to transfer physical cash to each other, one of those parties may lack a bank account, or the cash collection may be far away and expensive to travel to. The Illimitpay app offers an easy and local solution to a basic need through the “uberization of the ATM”. The money sender locates the local Illimitpay representative and remits the cash with him or her. The representative wires the money to another representative nearest to the recipient, who walks to the representative’s place to collect the cash. The only thing needed by the representative is a mobile phone and a minimum of cash in hand available to handle the transaction. He or she collects a commission in the transaction. Representatives can operate from their home and reach customers by moped or by foot. They can also be a retail business, which may benefit from attracting more clients.

Way4 Wallet: platform for digital payment ecosystems - Maria Vinogradova, Head of Marketing Intelligence, OpenWay

Over 10 years ago, when OpenWay created the first digital wallet white-label platform in the world, the question that came up was: why would someone choose our wallet over cards? Some years passed, and now the more relevant question is: why would someone choose our wallet over another wallet? Although some countries still lack wallet infrastructure, in many regions, the wallet market is incredibly competitive.

Broadly speaking, wallets serve two segments: the merchant, who uses it to sell, and the consumer, who uses it to pay. People prefer wallets when the card infrastructure is too complicated or expensive, or simply unavailable, as in the case of the unbanked. In some regions where card infrastructure is unavailable, people may use QR codes or USSD for payments. But in regions where there are many digital wallets on the market, the consumer tends to select one based on other criteria, whether or not the wallet is being perceived as a good partner. We will now go into that in detail.

1. A good wallet partner understands who we are and what we need, as part of a family or a hierarchy of a company or an organization. For example, if we are working abroad, we need an easy way to send remittances to family abroad. When we go out to eat, we need a way to split bills. As part of an enterprise, we need to track where the money is going, to make sure that people receive their wages and can spend them. If we are merchants, we need a way to accept payments across a variety of locations and online.

The more companies understand what customers want and need, the more their wallets will be used and the more the likelihood that these wallets will be recommended to the customers’ friends and family. This is what drives growth of digital payments and merchant services at a stable rate, as shown by the Ant Group’s revenue data from 2017 to 1H2020.

Ant Group’s revenue data from 2017 to 1H2020

However, more than half of the revenue these companies got was from non-payment value-added services, as shown by the chart below. What kind of services were they?

This leads us to the next characteristic.

2. A good wallet partner understands that we enjoy experiences, hobbies, and interests, and these involve using services, often together with others. Using the wallet should be easy and pleasant and not distract us – be a seamless part of our life. Popular wallet services might be classic ones like credit, investment, and insurance, but we also see increasing popularity of non-payment services like bike rentals, movie ticket purchases, transportation services, discounts for eating out. Those companies who ignore such services will miss out on a big chunk of revenue.

Ant Group Historical Revenue (2017 to 1H2020)

3. A good wallet partner makes our life easier. Any organization can create services and products by itself and market them on its own, but the good news is that there is no need for anyone to develop all these tools themselves. With the right wallet partner, we can connect to partner banks, merchants, insurance providers, government agencies, other wallet providers, and start-ups.

4. A good wallet understands our need for personalized services. We want to feel that the things we use are designed especially for us. Since the wallet platform deals with a lot of data, we can use it to make the content of the wallet more relevant for the customer. For example, a customer is purchasing an expensive bike, and using online data analytics, we see that he is making a lot of purchases while his balance is low. Maybe this is the best time to provide him automatically with credit. The wallet can send an automatic message about a credit or instalment option.

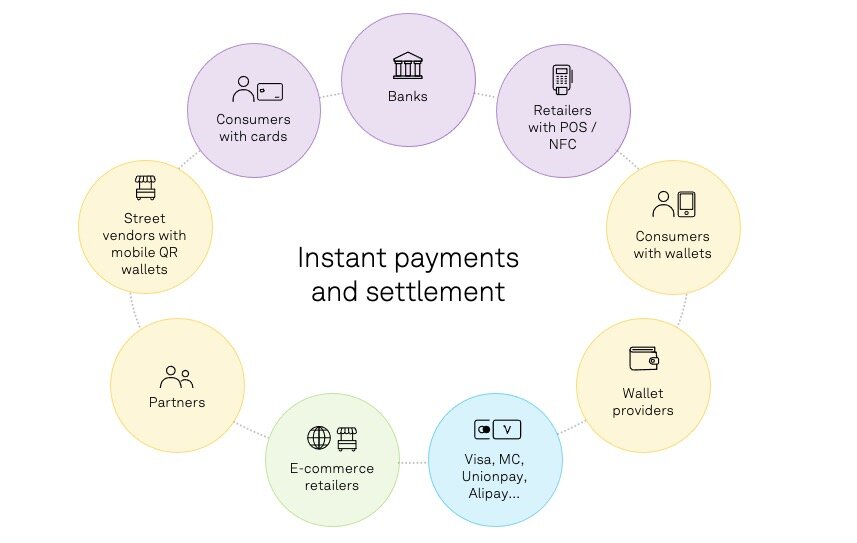

5. A digital wallet ecosystem has to be as inclusive as possible. One day we might want to partner with an e-commerce merchant or a brick-and-mortar shop, and provide them with instant settlement. Another time we might decide that we want to release a local or co-branded card. Later we might want our cards to be accepted internationally.

Way4 Digital Wallet ecosystem

These key principles are behind the success of Way4 Wallet solutions. They have allowed our clients to reach extraordinary targets, such as SmartPay’s 1,7 million customers onboarded within a year and a half.

The Way4 platform allows clients to create a personalized wallet for individuals, corporations and merchants, with both payment and non-payment value-added services. Way4 Wallet solutions allow digitalization of related processes, such as fast customer onboarding, dynamic pricing, instant payments and centralized clearing and settlement. They support omni-channel management and APIs to connect to partners and other systems. They analyze data in real time. Security is provided by internal tools such as fraud prevention and tokenization, as well as compliance with the latest industry regulations PA DSS, 3-D Secure 2 and GDPR.

Way4 Wallet, like all Way4 solutions, can be implemented both on-premise and in the cloud. Way4 won a PayTech award in 2019 as the best payment provider in the cloud.

Questions and Answers

The Q&A session was moderated by Valentin Alexeev, Business Relationship Manager, OpenWay.

Valentin: What is the most unusual wallet you have seen?

Kieran Hines: Unusual wallets usually focus on a very specific use case, such as a dedicated wearable wristband for Melbourne Oktoberfest. Wearable wallets may be developed more in the future.

Valentin: How do different services come into the ecosystem of SmartPay?

Marek E. Forsyiak: Vietnamese are extremely entrepreneurial. Individuals have full-time jobs but also their own side jobs. SmartPay offers a way for people to offer their products to millions of people with purchasing power, enabled by microloans made available through the platform. SmartPay focuses on putting technology in the hands of the customer (whether it is a merchant or a consumer), the product owner. We do not actually manufacture loans or services ourselves. We embed products and services of our bank and consumer finance partners as part of the platform and manage the experience for the buyers and sellers.

Valentin: In Africa, how will all the different emerging services and wallets co-exist?

Papa Mbaye Dièye: The ecosystem shows that there are several silos in Western Africa. Some are led by banks, micromerchants, and others who occupy distinct niches. But we would like to set up bridges between them – between payment providers and government services, microfinance, and others. This will increase the number of digital service providers in the region. The goal of these interoperability projects, in which OpenWay plays a part, is to get more volume in financial services, more users, and give them useful tools to perform their financial tasks within a common region. ()

Valentin: What was the approach that allowed SmartPay to gain so many customers within only 18 months?

Marek E. Forsyiak: SmartNet has been distributing financial services and products for a number of years, so an advantage was that they already had over 2,500 direct sales agents around the country. They already had the benefits of an experienced team who knew how sell advanced consumer services through SmartPay to an underbanked audience. Direct sales force has been instrumental in helping people use the app in the way it was intended to be used, from onboarding to first use. Also, the company was well-prepared in anticipating abuse of technology and bad actors. Since SmartPay acts as a custodian of people’s money, they are proactive about preserving the assets of customers and have control routines in place.

Valentin: What is behind the problems of adoption of wallets in Africa? How can companies overcome them?

Papa Mbaye Dièye: In many areas there is a lack of internet connection. Also, language might also be a problem, which can be overcome by starting with a local language module. Governments can also help with the adoption of digital wallets.

Valentin: How do challenges related to Covid-19 affect the development of wallets?

Maria Vinogradova: Those requesting card issuing and acquiring merchant solutions used to be separate from those requesting wallets. But more recently, customers are asking for combined solutions, because sometimes, it is not possible to offer a good digital payment solution without some wallet elements. Banks are more often asking for an interesting card solution with wallet functionality. The pandemic has challenges but it also helps technology become more adaptable and be launched faster.