SmartPay Reaches 100,000 Points of Sale and Nearly a Million Individual Users

Less than a year after SmartPay was launched in late May 2019, SmartPay has developed rapidly with more than 100,000 points of sale nationwide.

This impressive result testifies to SmartPay’s dedication to its smart payment solution, which helps merchants all over Vietnam integrate into the modern global digital ecosystem.

Joining the race much later than other businesses in the same industry, SmartPay chose a different direction, which is to follow the merchants. SmartPay not only focuses on big cities, but also on developing provinces and towns. According to statistics, among the top 10 cities that SmartPay "covers", about 80% are developing provinces and towns where new technologies have not been able to "get in the way" yet.

A large number of SmartPay sales staff is always available to provide customer support on installing and using the SmartPay Wallet

SmartPay supports small businesses who have to work to catch up digitally to play on the same level as industry giants. So it focuses not only on integrating the latest technologies and ensuring that requirements of information security are met, but also developing a simple product for regions where technology is not readily accessible. Moreover, SmartPay has a staff of thousands of sales associates covering 63 provinces and cities of Vietnam. This team regularly visits and advises merchants and is ready to assist with SmartPay installation and training when necessary.

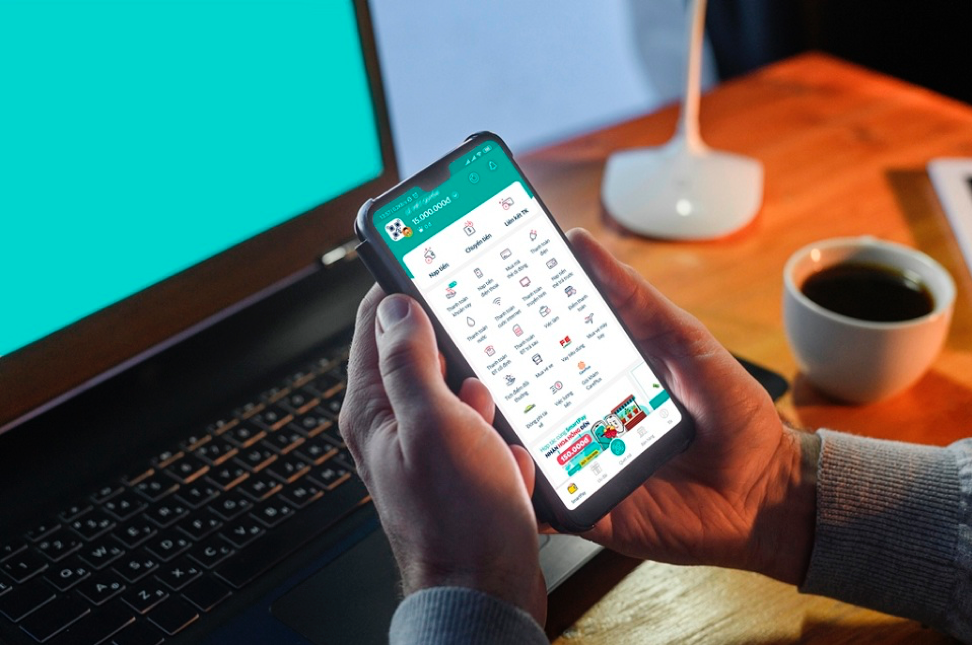

So now, with only a smartphone with the SmartPay application installed, any local merchant can manage revenue and expenditure, create promotions, and offer QR payments to attract more customers.

Now, merchants can use SmartPay to manage revenue and expenditure, earn points, create promotions encouraging customers to use QR payment and other marketing campaigns to attract customers.

In addition, SmartPay also strives to find solutions to support affiliate merchants, helping them increase their monthly income by introducing customers in the provinces to personal e-wallets, loans, insurance and utility payments (electricity, water, television, internet, and so forth).

SmartPay understands that most small businesses do not have the same advantages as large businesses. It will be difficult for them to access loans to expand or revive their businesses after the current epidemic. As a strategic partner of many large corporations in finance and banking such as FE Credit / VP Bank, SmartPay has introduced financial and banking services in its application, enabling merchants to access loans and quickly apply for them. The loan approval and financing process is fully automatic, which means merchants can quickly access capital for investing in the development of their business.

Besides providing solution for merchants, SmartPay has also become a trusted partner of one million individual customers who make daily payments, helping them save time and money, and contributing to their wellbeing. The application is available now and is being further developed by SmartPay.

SmartPay is gradually becoming close friends of nearly 1 million customers in the country

Currently, cashless payment is being promoted in many countries around the world, especially during the time Covid -19 was raging. This new form of payment is increasingly showing its role in protecting public health. In Vietnam, this is a trend that will "explode" in the coming time if the pilot project of mobile money is approved by the Prime Minister.

“Recognizing the changing trends in business, so right from the start of SmartPay, we always wanted to create a fair" playing field "where small businesses can use smart payment technology. on their business. Thereby, we hope Vietnamese small businesses can confidently join the global digital economy. By 2020, we aim to bring SmartPay to nearly 1 million merchants and reach about 4 million individual users. ” - says Mr Lu Duy Nguyen, SmartPay Product Development Director.

SmartPay e-wallet is an application of Smart Network Company Limited (SmartNet). Entering the market in May 2019, SmartPay always maintains strict data security standards. As a result, SmartPay has received the 2nd level PCI DSS (Payment Card Industry Data Security Standard) international security certification from Crossbow Labs.

Besides, due to continuous contributions to Vietnam's financial industry, SmartNet, the company that owns the SmartPay e-wallet, has been admitted by Vietnam Banking Association (VNBA) to become a member under Decision No. 40. / QD-HHNH takes effect from October 24, 2019.

Source: Tieudung.vn

Mobile Wallet Solution Powered by Way4

The SmartPay wallet is powered by the WAY4 platform, provided by OpenWay, a global leader in software solutions for card issuing, merchant acquiring, transaction switching, and digital wallets.