#OWInsights: How to Launch Payment Innovations Faster

Despite the global hardships of this year, some valuable insights are emerging from banks, processors and fintechs who are managing to keep their competitive advantage in the payments industry.

Dmitry Yatskaer, CTO of digital payments solution provider OpenWay, related how companies have leveraged innovative technology to become payment leaders in their market. These real-life cases show how greater investment in delivery speed, in-cloud solutions and remote migration is keeping OpenWay’s clients profitable in an uncertain economy.

You can continue reading this article or watch the video version of it by clicking the button below.

1. Speed of innovation: a key competitive advantage

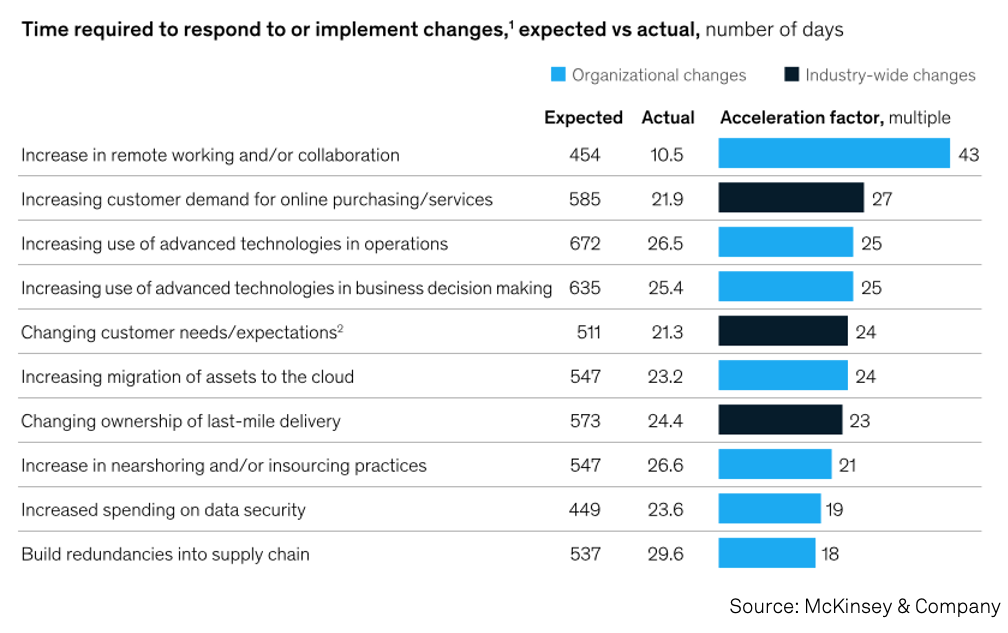

Even with worldwide disruption to the global economy, an intriguing report by McKinsey showed that 70% of companies who invested in technology achieved organic revenue growth through the crisis. Interestingly, banks, processors, fintech, and other payment players are implementing innovations and changes related to the COVID-19 pandemic 20 to 25 times faster than they thought possible before the crisis. The trend of acceleration is especially visible in remote working, online service delivery, digitalization of operations, migration to the cloud, and other business areas.

Companies implemented COVID-19-related changes 20 to 25 times faster than they thought possible before the crisis

The strategic position of many organizations is also changing to reflect the emphasis on innovation – surveys report that 87% of executives currently see technology as the key competitive advantage. Regarding their organizations' current strategy, 38% will be investing more in technology, 19% will be refocusing the entire business around digital technologies, and 30% are modernizing core technological capabilities to keep up with competitors.

87% of executives now see technology as the key competitive advantage

All the data points to the same fact: the acceleration trend is more than ever relevant to the payments industry. Let’s see how OpenWay’s clients – leading payment players around the globe – are actively leveraging technology to keep up with change.

2. Remote migation with no delays

The inability to travel seems like a huge setback for migration, but companies have enjoyed successes with both cloud and on-premise remote migration with the right vendor. OpenWay’s experience shows thatchallenges of remote migration can be overcome with a flexible and technologically competent team dedicated to meeting pre-pandemic deadlines.

A good example of the remote project in merchant acquiring space is the launch of a new, consolidated Way4 merchant management platform at a major acquirer in Italy, NEXI. Now the processor is going to migrate over 1,000,000 merchants to the new platform. A close and entirely remote collaboration made the migration a smooth part of the company's transformation program, with 0-day delay in the implementation schedule.

The lesson? Now, more than ever, it is crucial for businesses that technological solutions are ready for remote installation, and that vendor teams have the relevant migration methodologies and strategies to implement remote projects successfully.

3. Customer enrolment in minutes, bank onboarding in days

Customers are increasingly expecting instant and digital services, from customer-facing ones like digital onboarding, to back-office operations such as instant merchant reconciliation and settlement.

Superapp SmartPay, a digital wallet ecosystem that uses the Way4 platform to connect consumers with SME merchants in Vietnam, is a good example of instant payment services. It has been able to onboard 1,700,000 wallet users, including 300,000 micro, small and medium merchants, in just 18 months. Thanks to Way4’s online back office and integration with digital KYC, it takes less than 5 minutes to enrol into the wallet and start sending and receiving payments. Additionally, SmartPay provides instant reimbursement to merchants, and easy access to credit and savings products via online integration with bank partners.

Enfuce offers payment processing to fintech and neobanks. Because it runs the Way4 platform in the cloud, the company is able to provide clients with unparalleled scalability and fast time-to-market. Client onboarding at Enfuce takes 7 days for a fintech and 6 weeks for a bank. The platform ensures 99.99% service availability.

After migrating to Way4, Credorax transformed from a start-up to a global e-commerce acquirer, entirely online and payment-agnostic. In a few years after the migration, they achieved a CAGR of over 52%. It takes them 48 hours to onboard a merchant in a 100% digital process, all checks included. Credorax uses Way4 to offer an acquiring and payment gateway service in 30 countries. The platform automates clearing and settlement for all transactions, including fees, regardless of the transaction country and payment method used.

4. Release new products faster

As the experience of OpenWay’s clients shows, the ability to roll out new products quickly ahead of the competition is crucial to getting the lead in the market. It is also important to monitor changing customer expectations and demands in real-time. What allows you to do both? A payment platform that can process data in real time and support online workflows for a wide variety of service scenarios.

In Greece, after a crisis in 2015, the government set a cashless society as a goal, which motivated the National Bank of Greece to migrate their cards to the Way4 platform. Use of innovative data streaming solutions enables real-time data exchange between the bank’s systems, so it can offer new real-time services to cardholders such as instantly approved overdraft or loyalty program bonuses. Payment switching for 280,000 POS terminals and 1,400 ATMs is now being successfully migrated from the legacy Base24 system. Also, the bank manages 4,600,000 cards in the Way4 system.

This year, Nets and OpenWay have received a Paytech Award for their API-based digital lending platform where customer can get a loan in minutes, both in-store and online. Nets relies on its Way4-driven payment processing platform to serve multiple major issuers and to rapidly onboard new customers. Thanks to Way4, the processor can offer its banks not only the ability to issue debit and credit cards, but also to create lending and financial products and other value-added services on a universal platform.

5. Proven technology for uncertain times

So how can companies select the right payments technology during these uncertain times with confidence?

Whether a vendor can be a trusted partner is often shown by its recognition by the industry. It should have a track record of successful projects of various scales in different global regions and economies.

The current financial environment can change quickly, and any business line can experience declines in profits. This requires flexibility from the payments platform, allowing quick and easy expansion to other business lines.

Besides the right vendor and the right solution, companies must decide on the most relevant business model for running the solution: how deeply do they want to be involved in managing the technological platform? Do they have enough maturity in the payments business to do it themselves, or is it better to outsource some processes?

Ranked No. 1 in digital wallets and CMS by Gartner and Ovum, the Way4 platform has been proven to support a diverse range of issuing and acquiring strategies and service models. Way4 is able to accommodate multiple payment solutions on a single platform: merchant acquiring, card issuing, digital wallets, payment switch, and fleet solutions. Both classical and innovative payment solutions are fully covered. OpenWay customers can run the platform either in-house or in the cloud. They can fully manage the platform themselves, or request managed services from OpenWay according to a Way4 SaaS model. Another way for companies who don’t need customized products to quickly launch a new payment business is to outsource their processing needs to a processor running Way4. Among them are card issuing and merchant acquiring processors who lead the market in their region.

Adopting new technology quicker and adapting it to the speeding pace of change has never been easier. Contact OpenWay to learn more about Way4 payment innovations.