PSD2 - Time To Act is Now!

Time of uncertainty about PSD2 has passed - the market has accepted the idea of open banking and payment decentralization. And many players have realized that their legacy platforms do not fit this new reality.

Can you achieve compliance with PSD2 in a short time-frame and not put your business goals on hold? Can you go beyond compliance and generate new revenue streams? Whatever you have as the core of your payment infrastructure, can it orchestrate multiple systems efficiently, without repetitive hardcoding? Can it ensure an amazing customer experience for those you serve?

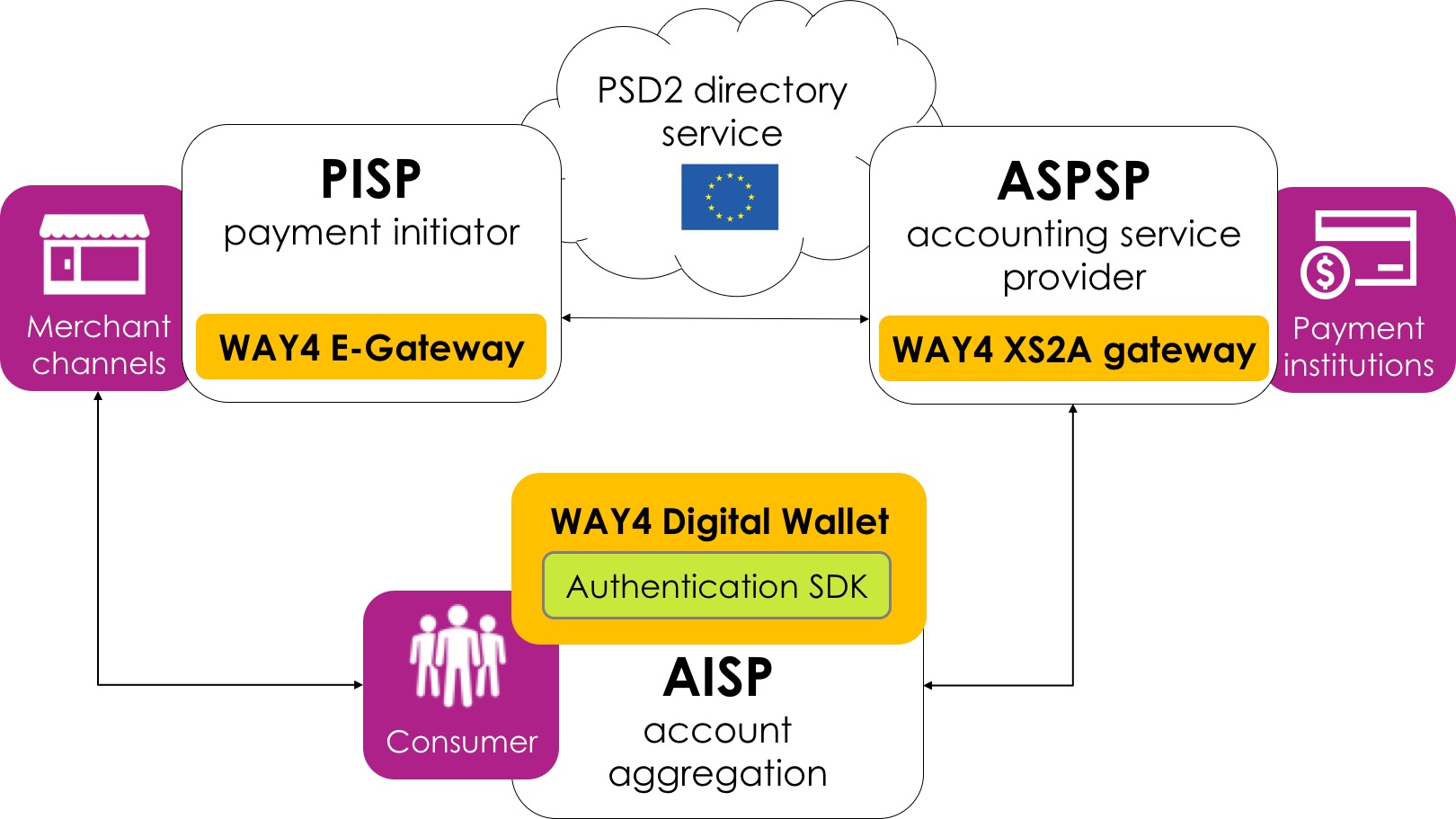

Whether you want to play the roles of Account Servicing Payment Service Providers (ASPSP), Account Information Service Provider (AISP), Payment Instrument Issuer Service Providers (PIISP) or Payment Initiation Services Provider (PISP), the WAY4 PSD2 Hub software solution will empower you to be PSD2 compliant and to seize new opportunities of open banking and instant payments.

What we offer is the WAY4 PSD2 Hub. It is built on the WAY4 software platform that got highest rankings in digital payment solutions. The platform has been proven by tier-1 European and global players to process complex transactions within milliseconds while achieving highest security standards, managing millions of online transactions per day, and continuously inspiring customers with the latest innovations.

For Business

Be compliant and provide transparent pricing terms and conditions to your clients

Launch different business models and generate new revenue streams on the same platform: ASPSP, AISP, PIISP, PISP

Exploit business potential of PSD2 by providing value-added services: instant payments, alternative payment methods, digital wallets, PMF, loyalty and other

Facilitate cheaper and frictionless onboarding: connect various KYC and digital identity providers online

Monetize APIs based on freemium model: provide basic services free of charge and generate revenues on access to level-3 transaction data and customer inside

Apply different API monetization mechanisms: pay per use, subscription fees, revenue-sharing leading and others

Generate more value for your clients thanks to 3d-party online services

For CIO

Provide access to 3d-parties through rich API and ISO20022 messaging

Reduce fraud via improved identity verification and authentication standards: 3-D Secure 2.X, biometrics, mobile push and so on

Orchestrate messaging flows between different API infrastructures easily

Fuel start-ups inside your company with 3d-party online cooperation

Are you an ASPSP?

To win the open banking game, your card or account must become the top choice even in the 3rd party services. To simplify this challenge, WAY4 supports different authentication methods and ensures secure and seamless payments from accounts.

What you get with WAY4 PSD2 Hub if you are APSPS:

PSD2-compliant payment processing workflow as a part of the ASPSP function

Stand-in processing for PSD2-related payments against core banking / debit accounts

Strong customer authentication

Transaction risk analysis

GDPR-compliant personal data management

Integration with your preferred API management systems (developer portal, sandbox, security)

Bundled APIs packages proposed to TPPs: standard mandatory APIs and premium APIs for extra data not covered by the PSD2 mandate

Become AISP or PIISP

AISP

The AISP role allows you to generate revenue on accounts data aggregation and customer profiling. Use WAY4 Wallets, our all-in-one digital wallet software system, to improve in-store, e-commerce and mobile shopping experience for your customers. You can link different customers accounts to your mobile app and create your service on top of them - i.e. analytics, instalments, loyalty.

PIISP

As PIISP you can issue any payment instruments for your customers on WAY4 and offer payment and non-payment value-added services. Our solution is a unified platform for digital wallet, online payment processing and online back office (including customer on-boarding, product setup, account management, loyalty programs, and more).

You can achieve all of that with the WAY4 Wallet solution that is integrated into WAY4 PSD2 Hub:

White-label digital wallet platform

Strong customer authentication

Instant payments & transfers from payment instruments of multiple issuers

Personal finance management

GDPR-compliant personal data management

Full-fledged back office management

WAY4 PSD2 Hub: mobile check-out and strong customer authentication via QR

Become PISP, or Launch Digital Network for PISPS

To become the preferred PISP for merchants, you need the gateway that accepts all popular payment methods, remain highly available -basically, never fails - and remain cost-efficient. It should also be scalable sand flexible to connect with different payment systems.

All this is covered by WAY4 Payments, a part of the WAY4 PSD2 Hub solution:

Cards & alternative payment methods

PSD2 compliant payment processing

3-D secure

Advanced risk monitoring

Nets and OpenWay Collaborate on Open Banking

Solution for payment players adopting PSD2 as a step towards Open Banking services & revenue streams

WAY4 PSD2 Hub at a Glance

API

Core banking

Card management

Risk monitoring

Mobile, terminals and other channels

Channel

Gateways

AML

CRM

BI systems

Acceptance

Payments from accounts

Alternative payment methods

Cards

Authentication

Mobile push

Biometrics

SMS OTP

Mastercard Idenitity Check

Google Authenticator, etc.

Compliance

PSD2 workflow

GDPR support

SEPA

Berlin Group

Online Payments

Instant payments

Online 24/7/365

Stand-in

Smart routing

Parallel request processing

Security

Strong customer authentication

Risk-based authentication

Transaction risk analysis

3-D Secure 2.Х

Digital Wallet

Friendly UX, UI

Tokenization

Loyalty & Bonus clubs

Contactless & QR