Battle of cards and wallets?

Table of contents

Click on a header to skip directly to that section.

Banks and the challenge of keeping up with post-crisis payment habits

One might hope that all the turbulence brought by 2020 will die down over the next few years. But many habits developed during times of crisis have survived generations. This fact may explain those strange consumption choices that people were making at the start of the pandemic. For example, stores in Western Europe ran out of toilet paper, whereas those in Eastern Europe ran out of buckwheat. Were people influenced by a collective subconscious memory of deficient goods during the social and economic collapses of the past century?

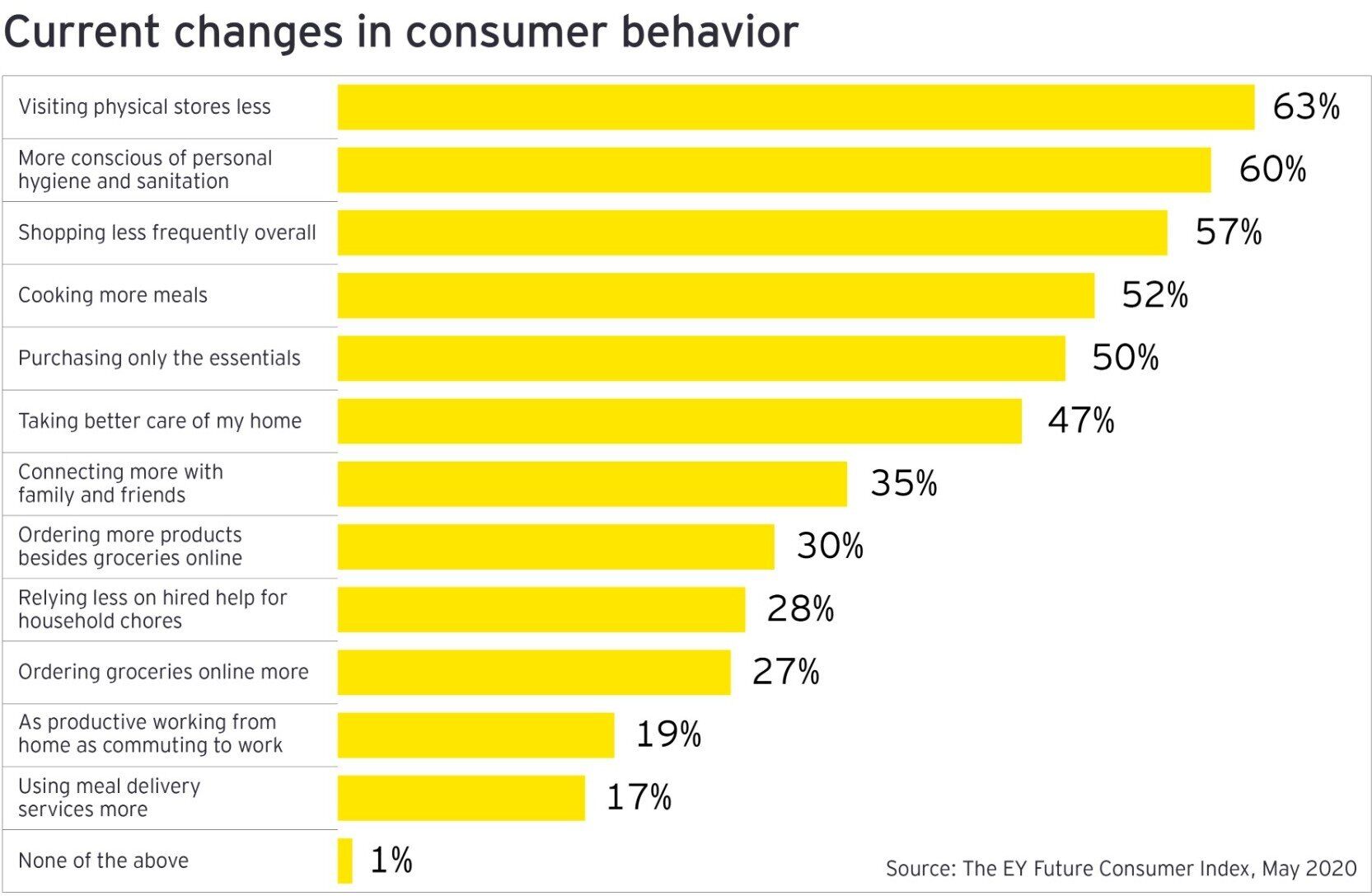

The current collapse is changing not just the contents of our shopping carts, but also how we pay for them. Before the pandemic, choosing between cash, cards and mobile wallets could be a spontaneous decision or personal preference. But now, personal health concerns are overruling other considerations. New habits relating to safety and hygiene during the payment process are likely to remain for a long time. Among consumers surveyed in May 2020 by E&Y analysts, 51% agreed that “the way they shop will fundamentally change.”

If you work in the payment industry, you may want to understand these changes in detail and whether your company can adapt its offerings to fit into the new realities. Obviously, brands perceived as a safer payment choice are likely to have a brighter future.

This case study explores how banks, neobanks, processors and fintechs across the globe are addressing new consumer habits. Which payment services have helped some players retain customers and attract new ones despite the crisis? Also, who has more advantages in this competition – card issuers or mobile wallet providers?

The habit of distanced payments

Let’s imagine Aline, a typical bank customer, adjusting to pandemic and post-pandemic times. For the first three months she stayed at home, worked remotely and went outside only to buy essential goods. Then her country of residence waived self-isolation restrictions.

Here is the paradox: the more people return to streets and stores, the less safe a shopping trip can seem.

Whatever Aline needs, she tries to order it online, and so do millions of consumers around the globe – according to McKinsey, the world has seen “triple-digit growth in nontravel e-commerce”. Now, more people are used to paying via Internet and in-app checkouts. If funds could be withdrawn from a customer’s account only after successful delivery of goods, this would be the favorite e-commerce payment scenario of any customer.

Still, some goods have to be bought offline, and Aline can’t help worrying about her in-store experience. “How can I minimize my interaction with cashiers?” she wonders. “I don’t want to hold cash, cards, or payment receipts. I don’t want to touch a POS terminal!” She is ready to try mobile NFC or QR code payments, even if the terms are unfamiliar to her. These payment methods are contactless, and, as McKinsey reveals, their “perceived hygienic security is higher than it is for normal POS payments”.

Aline’s new payment habits might include in-browser and in-app checkouts, in-store contactless transactions, online P2P transfers, and online loans and deposits. But first of all, she needs an NFC-enabled card and a digital wallet. Can her bank provide them without a visit to a branch? If not, Aline’s loyalty might vanish soon. She could choose a new bank or fintech that eliminates her health concerns by onboarding and serving her at a distance.

Cards or wallets? My bank or another bank?

There are multiple successful business models for online and contactless transactions. Some consumers just want to be connected to major brands – Apple Pay, Samsung Pay, Google Pay, Alipay and so on. Others trust domestic wallet apps which often enable QR code payments in addition to more common mobile NFC technology. As far as the issuing market goes, the demand is rising for digital cards. They can work as a prepaid, debit or even credit product. Their main advantage is that they can be issued to users without delay – via mobile or online channel. Those who want a plastic version can receive it by mail later.

Which model best fits post-crisis consumer habits? The answer is equally important for financial institutions all over the world. So far, Asia and Africa were outpacing Europe and North America in digital payments adoption – a phenomenon which is explained in depth by Chris Skinner. But now, the contrast between world regions is likely to lessen. According to McKinsey, banks in both Italy and China “have found that many people readily used remote channels and digital offerings” during the pandemic. Competition in the digital space has intensified, even in European and North American countries.

Mobile payment transaction volumes in the US is projected to grow steadily and to match the worldwide pattern. Source: The State of Mobile Payments in 2019. New ETA Report.

Many payment providers seem to underestimate the risk of losing customer loyalty, rather focusing on maintaining the status quo and rearranging their day-to-day operations. At the same time, some agile banks and fintechs have speeded up their digitalization and succeeded in protecting their market share – and have even onboarded new customers. The most attractive payment offerings are usually those that combine card and payment technologies, with value-added services on top – such as instant online loans, deposits and multi-currency operations.

Digital wallet users – going against stereotypes

Are wallets just another fad among high-income users with premium smartphones? Or is it the last resort of the underbanked and unbanked? Such myths used to slow down the adoption of digital wallets in many countries, which meant their populations often went without handy apps that could be used to make hygienic payments.

But in some countries, digital wallets are the top choice nationwide among payment tools. In China, most retail transactions rely on Alipay and WeChat apps instead of cards, even among middle-class buyers. A similar trend seems to be emerging in Vietnam.

A typical Vietnamese consumer has access to a dozen wallet apps, and the list keeps growing. Some of them may eventually be discontinued, while others are steadily increasing their market share. One successful wallet provider is SmartPay. Launched in May 2019, it has developed rapidly within a single year and enrolled more than 1,000,000 consumers and 100,000 merchants across the country.

Why is SmartPay so popular? It has met the needs of multiple customer segments – the unbanked, the financially secure and tech-savvy, online merchants, street vendors, financial institutions and more. SmartPay unites all of them in a unique mobile payment ecosystem. Members can buy and sell products and services, pay and accept payments via QR codes, make P2P transfers, accrue and redeem bonus points, apply for bank products, order digital content and e-tickets. SmartPay was designed as a multi-purpose digital wallet. Its online and contactless payments have become not only convenient, but literally vital during the current health crisis.

The same crisis took many developed countries unawares, despite their mature payment infrastructures. Even established digital payment providers could not address all the emerging patterns.

Annoying gaps in contactless and online payments

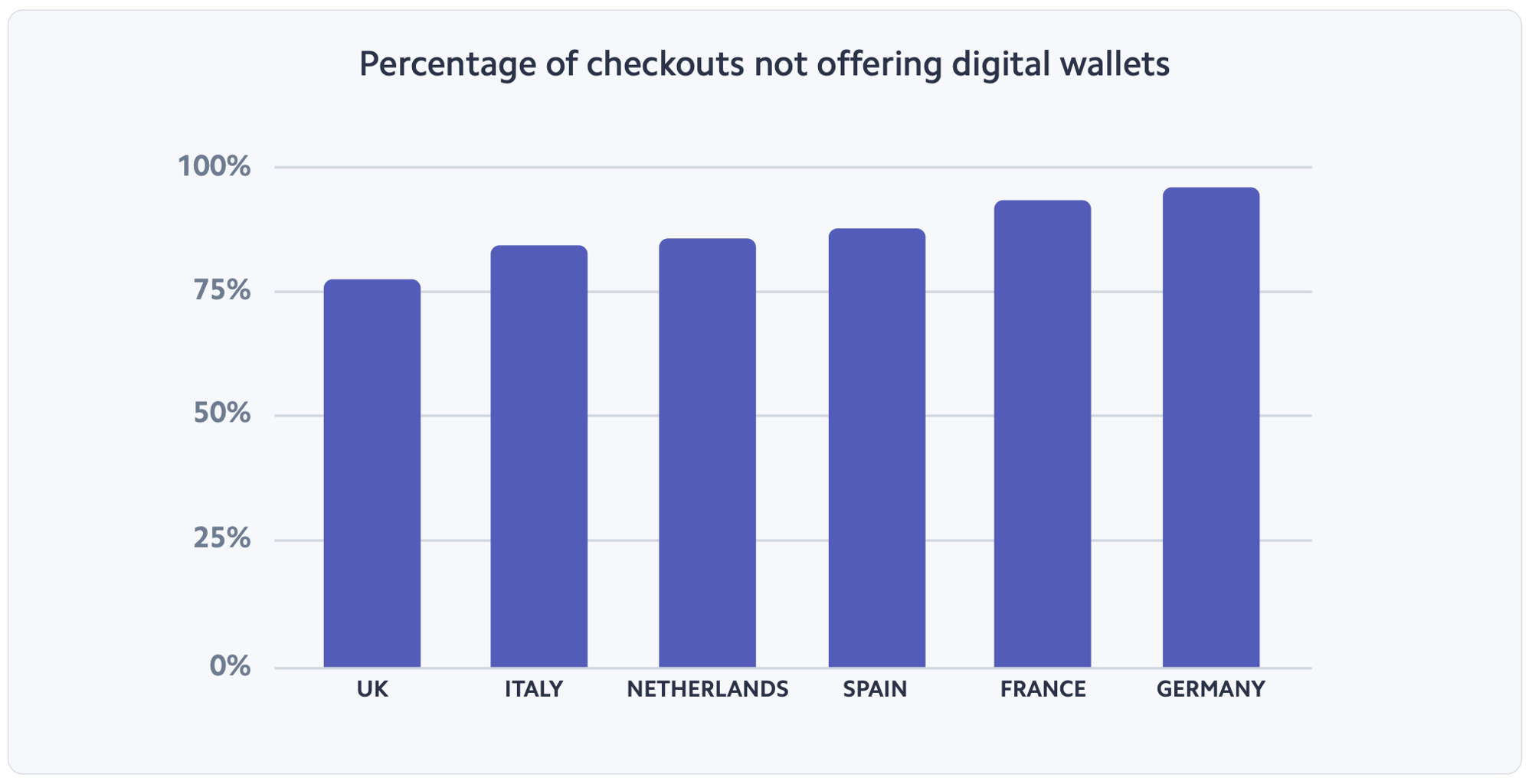

In Europe alone, 70% of e-commerce checkouts don’t support wallets – not even in countries with the largest economies, as reported by Stripe in 2020.

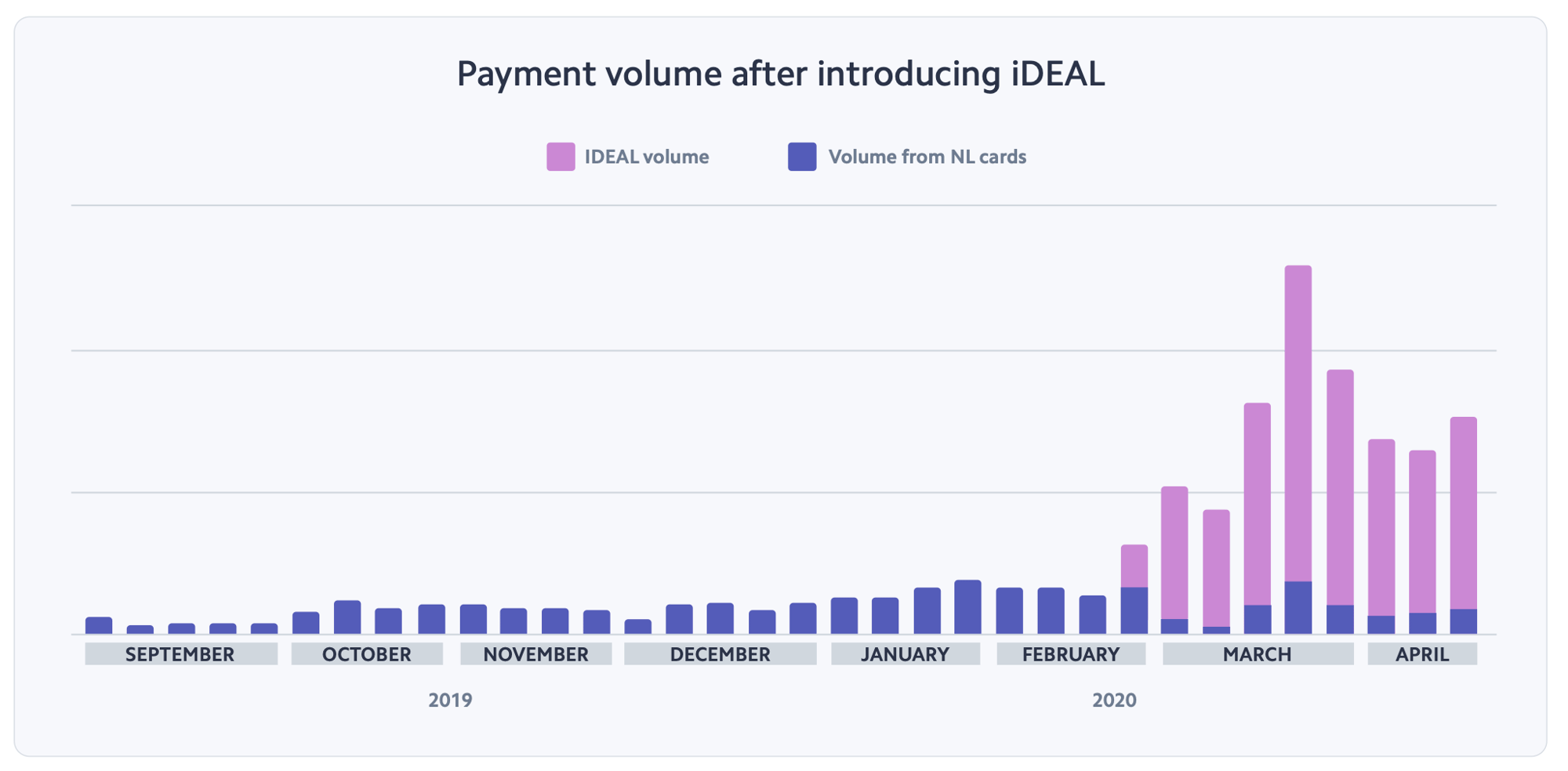

It looks like European payment providers are underestimating the convenience and importance of wallet payments. What about consumers? Consumers, in fact, are actively using digital wallets for e-shopping wherever they can, as demonstrated in Stripe report. For example, in the Netherlands, the popular domestic wallet iDEAL is used by over half the population. Three large retailers in Hong Kong decided to attract more Dutch buyers to their e-commerce websites by enabling iDEAL as a checkout option. After this, their orders from the Netherlands grew by 79%. Apparently, the loyalty of the Dutch to their wallet brand is reflected in their trust in their wallet’s partner brands, including those of overseas merchants.

In Belgium, a popular domestic mobile wallet for online, in-store and P2P transactions is Payconiq by Bancontact. The speed of its adoption is promising. In 2018 it processed 34 million mobile payments – an increase of 100% compared with the previous year. By July 2019, over 60,000 merchants across the Benelux region have connected to the Payconiq wallet platform.

Still, the Payconiq ecosystem in Belgium has a weakness: lack of acceptance in physical stores. Although the Payconiq mobile app supports QR code payments, they are rarely enabled by offline merchants within the country. Mobile NFC is supported, but only by the app’s Android version.

Yes, here is an unexpected gap. iPhone users in Belgium cannot tap-and-pay on POS using their domestic wallet. What’s worse – most of them cannot use ApplePay on POS either, since the majority of domestic banks have not implemented ApplePay. Perhaps they were discouraged by pre-pandemic surveys when, in 2017, only 30% of customers expressed interest in contactless payments. Of course, the lack of interest could be explained by the fact that without ApplePay, iPhone users could not appreciate the convenience of mobile NFC. They did not promote this payment method among their peers as they typically do for mobile innovations. One may conclude that Belgians did not pressure their banks enough to speed up connection to large wallet brands.

Imagine that our Aline lives in Brussels and uses an iPhone. She probably feels underserved in terms of convenient payments. If she orders meals via Too Good to Go, a popular mobile app, she has to pay the old-fashioned way – by providing her Belgian payment card data. While she is typing, the deal may be sold to anyone who paid faster via ApplePay. It may be, for example, a Belgian customer who holds a card issued by N26, a German neobank.

Digital card plus wallet: an enticement to switch banks

N26, the neobank headquartered in Berlin, successfully recruits customers in Belgium and other European countries. It offers proven connections to major wallet brands. When Belgians go to the Apple website and check recommended Apple Pay providers, they won’t find many of their domestic banks. But N26 is on the list, along with other foreign neobanks – Monese from Great Britain, Bunq from the Netherlands and iCard from Bulgaria.

_2018_logo.svg.png?width=500&height=348&name=1200px-N26_(Direktbank)_2018_logo.svg.png)

What cards can do that wallets can’t

While mobile wallets are proving convenient during the current crisis, some limitations are also coming to light. At the beginning of the pandemic, PYMNTS.com was tracking the dynamics of in-store payments made within the US. Apparently, the percentage of wallets among all POS transactions in this country was going down, despite projected growth. For ApplePay, it was 5.1% in March 2020 as compared to 6% a year before. For Walmart Pay, the decline was even greater.

An interesting hypothesis appeared lately in a LinkedIn payment industry community forum to account for this phenomenon. Traditionally, major mobile wallets supported biometric authentication, and users of advanced smartphones relied on this feature during in-store payments. When people began to wear masks and gloves, facial recognition and fingerprint scanning on mobile stopped working reliably. It was not until May when a new iOS update made it easier to unlock an iPhone while wearing a mask. It explains why more consumers may have decided to make mobile payments at online stores only, and stick to contactless cards in physical stores.

Since many banks already issue contactless cards, this feature in itself cannot be a competitive advantage. Issuers have already begun to compete by providing value-added services. In particular, the crisis has increased customer demand for online loans, deposits and multi-currency accounts.

Multi-currency cards and accounts

The local currency is volatile in many countries, and FX exchange rates can fluctuate even more in times of crisis. For example, in just one month a deposit made in Kazakhstani tenge can lose one third of its value, if we compare its equivalents in euro before and after the fluctuation.

Basically, the Jysan Bank product combines many accounts in different currencies linked to the same card. It is replenished with cash or via money transfer. Customers choose between 16 currencies and move funds between them via online banking anytime they want. It means that they can react in a timely way to FX fluctuations even during the pandemic, when many bank branches and foreign exchange kiosks are entirely closed.

When the lockdown ends, Jysan Bank cardholders will probably have two habits related to their multi-currency card. They will use it not only to make payments abroad, but also for managing savings at home.

In countries with stable local currencies, are there clear benefits to using a multi-currency card? The answer is yes. This bank product increases the transparency of cross-border payments, and this benefits every bank customer.

People in both developed and developing countries are buying more and more goods from foreign merchants. This includes shopping during travel and online shopping from home. Many cardholders complain about international payment schemes that their currency rates are unfavorable and the FX conversion logic is unpredictable. But if the currency conversion is handled by the bank, consumers know the conversion rate in advance, and which particular rate will apply to the purchase in real-time.

Consumers with multi-currency cards have more control over how much they will be charged. Before paying, they can simply move the necessary funds to the account in the merchant’s currency. Or the bank itself can configure a processing rule that among all the consumer’s card accounts, the one that automatically gets charged is the one that matches the merchant currency.

As a result, the cardholder benefits from favorable FX rates and predictable charges. The bank gets revenues from converting currencies which it buys directly on the stock market or online through a partner. The latter option is preferred by some banks, such as Equity Bank in Kenya.

Pay-and-save: with cards or wallets?

The distinction between bank products for saving and those for payments has become blurred in the past few years, and this is a global trend. Now, during the crisis, people may need to move funds between these products even more frequently. For the sake of convenience, advanced issuers offer multi-purpose cards, where the same account is used to pay, to store money, and even to accrue interest on the remaining balance. But cards are not the only solution.

Some people would prefer to get a deposit or multi-currency product via mobile wallet. These customers include the unbanked population who lacks access to classic banking. It also includes tech-savvy users who like innovation and online services.

More and more banks offer the same product line in two different forms – as a multi-purpose card and as a wallet app with a rich service menu. Each form can fit the expectations of a particular customer segment.

Remote loans – in advance or during checkout?

The pandemic has brought financial challenges to many households worldwide. The situation may be especially tough in a country where most consumers don’t have a credit card. Even if they decide to apply for one now, the nearest bank branch may be closed. Even if the branch is open, most banks prefer not to issue a credit card to someone without any credit history. Even in-person borrowing from a friend is not a good option due to strict self-isolation restrictions in many countries.

The ability to get a loan remotely has become of vital importance. Both banks and fintechs are experimenting in this area to help their customers and to benefit themselves.

Cards and wallets: smart combinations instead of competition

What have we learned from the achievements and setbacks of Airtel, Apple Pay, Equity Bank, FE Credit, Jysan Bank, N26, Nets, Network International, Payconiq by Bancontact, SmartPay, and other digital payment providers?

We see that consumers like cards and wallets to work as a bundle, be accessible via the same mobile app, and be linked to the same payment account. The onboarding should be entirely remote – not only wallet activation, but also the issuing of digital cards. This would cover everyone’s need for safe, hygienic payments.

It’s important for this bundle to serve multiple purposes. In this case it can satisfy different customer segments and even succeed in different countries. Sometimes a payment wallet is a starting product for new bank customers. It gives instant access to various financial services, and a plastic card is delivered a bit later. Sometimes it is the other way around: the card is the primary product, and the wallet complements it in terms of online and contactless payments. Both scenarios have proven viable in both developed and developing markets.

Enticing customers away from competitors is easier with digital prepaid cards that are issued remotely and instantly, and without annoying identification steps. Such a card may be linked to both domestic and major mobile wallets. Banks can promote this product not only through their own channels, but also via mobile apps of partners – malls, online marketplaces, streaming channels, gas stations and others.

During the current crisis, people need better savings tools, easier access to credit funds and protection against currency volatility. A mobile payment app would be more attractive if it offers multi-currency cards, deposits and instantly approved loans. It should also guarantee remote delivery of these products and others to follow – because the habit of hygienic banking and payments is likely to stay long after the end of the crisis.

A reliable partner for card and wallet projects

Why did our team at OpenWay prepare this case study? We believe that the ongoing changes in consumer habits are opening new doors for our existing and future clients – banks, fintechs and processors. We believe that Way4, our software platform, will continue enabling innovative payment projects all over the world. Some of these projects are mentioned in this article: the mobile wallet ecosystem of SmartPay, multi-currency cards offered by Jysan Bank, remote loans by Nets, Network International digital cards, and others.

Our clients issue cards, operate mobile wallets, provide online and in-store acquiring services, and work as payment hubs and national switches in Europe, the Americas, Asia, the Middle East, and Africa. In 2019 alone, according to Nilson Report, the largest card issuers using Way4 have processed transactions with the combined purchase volume of 300,000,000,000 US dollars.

Gartner and Ovum have given our company top rankings for card issuing, merchant acquiring and digital wallets solutions. We have received the PayTech award as the ‘Best Solution Provider for Payment Systems in the Cloud’.

Would you like to roll out card and wallet innovations, all on the same platform? Do you have a planned project or an idea to discuss with an experienced team? Please consider OpenWay as your flexible and reliable partner. Click below to request the latest payment innovation brochures and get in touch with us.

OpenWay is the only best-in-class provider of digital payment software solutions, and the best cloud payment systems provider as rated by Aite and PayTech. OpenWay is a strategic partner of tier 1/2 banks and processors, fintech startups, and other leading payment players around the globe. Among them are Network International and Equity Bank Group in MENA, Lotte and JACCS in Asia, Nexi and Finaro in Europe, Comdata and Banesco in Americas, and Ampol in Australia.

Learn more: analytic reports, news and case studies

-

Bancontact Payconiq Company. Seven out of Ten Belgians Have a Payment App on Their Smartphone. 4 June 2019.

-

“Bank-Backed Cross-Border Wallet Payconiq Raises EUR20 Million.” Finextra Research, 25 July 2019.

-

Bhattacharya, Megha. “Payconiq Gets €20 Million Shareholder Boost in Latest Funding Round.” IBS Intelligence, 25 July 2019.

-

Bruno, Philip, et al. “How Payment Companies Can Adjust to the Coronavirus | McKinsey.”, McKinsey and Co, 31 Mar. 2020.

-

Buehler, Kevin, et al. “Leadership in the Time of Coronavirus: COVID-19 Response and Implications for Banks.” McKinsey & Company, 17 Mar. 2020.

-

Daxue Consulting. “Payment Methods in China: How China Became a Mobile-First Nation | Daxue Consulting.” Daxueconsulting.Com, 10 May 2019.

-

Groenfeldt, Tom. “Digital Banking Have You Befuddled? Chris Skinner’s Latest Book Has Practical Plans.” Forbes, 20 Dec. 2019.

-

Kanarick, Bill, and Laurence Buchanan. “Are You Agile Enough to Move with the Changing Consumer?” 28 May 2020.

-

N26. “N26 Celebrates 5 Million Customers in Time for Its 5th Birthday.” N26.Com, 23 Jan. 2020.

-

Pietsch, Bryan. “1 in 10 Card Transactions Could Be Done with Apple Pay by 2025, Providing Apple a Revenue Boost amid IPhone Sales Slump.” Business Insider, 13 Feb. 2020.

-

PYMNTS. How Life On Lockdown Has Transformed Consumers’ Spending. 1 Apr. 2020.

-

The ETA Mobile Payments Committee. The State of Mobile Payments in 2019. 2019.

-

“Top Credit Card Issuers Globally.” The Nilson Report, vol. 1166, 1 Dec. 2019.

-

“Top Debit card issuers globally.” The Nilson Report, vol. 1165, 1 Dec. 2019.

-

“Vivid Money Taps SolarisBank and Visa for Launch in Germany.” Finextra Research, 8 June 2020.